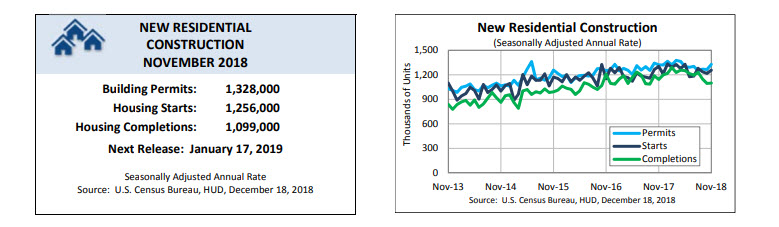

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly

announced the following new residential construction statistics for November 2018:

Building Permits

Privately‐owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,328,000. This is 5.0 percent (±1.6 percent) above the revised October rate of 1,265,000 and is 0.4 percent (±1.7 percent)* above the November 2017 rate of 1,323,000. Single‐family authorizations in November were at a rate of 848,000; this is 0.1 percent (±1.4 percent)* above the revised October figure of 847,000. Authorizations of units in buildings with five units or more were at a rate of 441,000 in November.

Housing Starts

Privately‐owned housing starts in November were at a seasonally adjusted annual rate of 1,256,000. This is 3.2 percent (±9.8 percent)* above the revised October estimate of 1,217,000, but is 3.6 percent (±9.4 percent)* below the November 2017 rate of 1,303,000. Single‐family housing starts in November were at a rate of 824,000; this is 4.6 percent (±8.4 percent)* below the revised October figure of 864,000. The November rate for units in buildings with five units or more was 417,000.

Housing Completions

Privately‐owned housing completions in November were at a seasonally adjusted annual rate of 1,099,000. This is 0.4 percent (±8.7 percent)* above the revised October estimate of 1,095,000, but is 3.9 percent (±11.5 percent)* below the November 2017 rate of 1,144,000. Single‐family housing completions in November were at a rate of 772,000; this is 5.4 percent (±7.6 percent)* below the revised October rate of 816,000. The November rate for units in buildings with five units or more was 314,000.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.