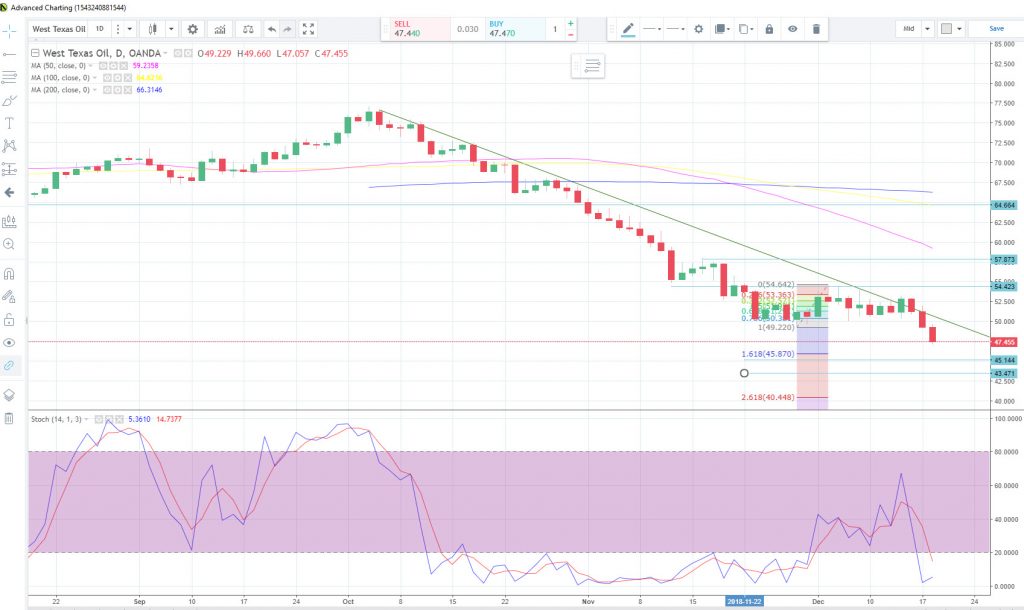

The fundamentals for oil remain very bearish. One day oil is lower on global growth concerns, the next day it falls on supply worries, and sometimes it drops on a risk off trading day. US West Texas Intermediate crude is now at 15-month lows after falling below the $50 a barrel level. OPEC and allies have now seen their production cut completely wiped out. The $42 level remains major support for oil.

Today’s slump with oil prices stemmed from more technical selling after yesterday’s close took oil below the pre-OPEC + production cut low. The collapse in oil prices also put a little dent with this morning’s equity rally.

With Russian oil production at record levels above 11.4 million barrels a day and US shale climbing to 8 million barrel a day mark for the first time ever, supply concerns are firmly in place. The softer economic data from Europe and China are also weighing on demand forecasts.

The Canadian dollar is also under pressure, falling to the weakest levels against the dollar since June 2017. The correlation with oil prices, Canada’s largest export has been high since the end of October.

If the bearish slide breaks below the $47.00 level, we could see the $43.50 to $45.00 zone targeted. With the market overly bearish on oil, traders should be aware that we could see a short covering rally any day now.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.