May faces miserable festive period as opposition grows

The final couple of weeks of the year aren’t typically the most exciting in markets but with the Brexit debacle rumbling on and the Fed and BoE meeting this week, we may not be in full holiday mode just yet.

As this isn’t exactly the most liquid time of year for markets, we could see some interesting moves over the course of this week, with Brexit being a particularly likely trigger point. Growing speculation about a second referendum comes as Theresa May bounces from a position of strength (ish), to weakness, strength again (post-no confidence vote) and back to weakness.

May came back from her most recent cap in hand visit to Brussels empty handed as she sought the assurances needed on the backstop to get her deal over the line. With Labour also just biding its time before launching its own no-confidence vote – this time in the government – to avoid the humiliation of the vote against May, the PMs hurdles are getting higher and closer together. I’m not sure May will have the legs to get over the line.

Peaceful start to festive period expected

As far as today is concerned, it could be a more peaceful start to the week. The economic calendar looks a bit light and traders around the world will be starting to check out with the festive period upon us. Asia traded a little in the green overnight and we’re expected similar movements at the open in Europe and the US as well.

Gold below $1,240 as dollar bears made to wait

Gold is a fascinating one right now as it continues to wait for the much talked about and as yet, non-existent, dollar decline. Despite the apparent growing list of dollar bears for 2019, the currency is holding up well with others, most notably the euro and pound, putting forward strong cases themselves to remain under pressure in the near-term. Positive developments on Brexit and the Italian budget would likely swiftly change that though.

Gold has dipped back below $1,240 despite strong efforts to stay above. This could point to short-term weakness in the yellow metal, with $1,220 being the next line in the sand below and $1,200 below that.

Oil remains near lows as Saudis target US stockpiles

Oil appears to have checked out for the holiday period, with the OPEC+ announcement earlier this month seemingly blunting the case for bulls and bears alike. Prices have since stabilised around their lows, which may come as a relief to producers hoping to arrest the decline, but it’s now over to the data to provide a case for the bulls and push prices back towards more sustainable levels. Reports of Saudi Arabia reducing exports to the US in an attempt to diminish the country’s stockpiles looks an exercise in just this, with the country being fully aware of just how closely traders monitor those inventory numbers.

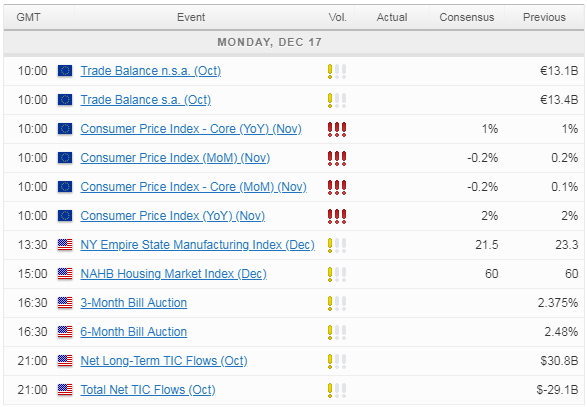

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.