Odds stacked against May as second referendum gathers support

It’s been a mixed start to trading on Monday, with Europe sitting in the red and the US looking flat ahead of the week open on Wall Street.

Heading into the festive period, trading volumes are expected to be significantly lower which could make things a lot more interesting as it’s unlikely to be the uneventful end to the year that we often see. Brexit will continue to be a source of potentially extreme volatility for the pound over the next couple of weeks as Theresa May scrambles around trying to save what’s left of her deal while everyone around her schemes to kill it and remove her and/or the government.

The odds are stacked against her at this point and her “friends” in Europe are in no rush to offer a lifeline. With support for a second referendum gathering momentum over the weekend, there is no incentive for them to back down on the issue of the backstop. It seems there is a number of steps that come before parliament accepts a no deal, which may force the EU into concessions, at least one of which could realistically see the UK remain in the block after all.

Interesting Week Ahead For Markets

Fed to set expectations for 2019

The Fed decision on Wednesday is another event that could shake things up in the markets. The central bank has been a key source of volatility in the markets since the beginning of October when Powell’s comments triggered a minor panic and correction in stocks. Since then there’s been plenty of speculation about whether the Fed will pare back its expectations for next year, or even hike this week which was almost entirely priced in, so Wednesday will certainly be interesting.

Source – CME Group

The most recent comments from Powell, combined with expectations of a slowdown next year and financial market instability look the perfect recipe for a downgrade to expectations, so naturally there’ll be huge scrutiny on the dotplot. With markets pricing in almost a 50 50 chance of one rate hike by December, the market has fallen well behind what the Fed has previously alluded to, leaving a huge divide that needs bridging.

OANDA Trading: Asia market update

Dollar support could weigh on Gold near-term

Despite the change in expectations, the dollar continues to trade close to its highs as developments elsewhere weigh on domestic currencies and lifting the greenback by default. It is trading a little lower today but in the near-term, I think it could remain well supported. This has taken some of the shine off gold which benefits most when the dollar is out of favour.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

It’s for this reason that I think, barring a messy no deal Brexit, gold could enjoy a decent 2019. Many people appear to be betting against the dollar next year – in part on expectations of progress in trade talks with China – and gold has been edging higher on the back of this. It’s dipped back below $1,240 over the last couple of sessions which may bring $1,220 back into focus but longer term I think it could be well supported.

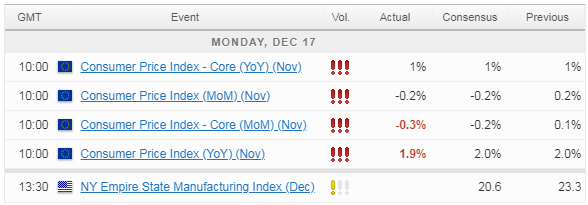

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.