Since the beginning of the year, the Australian dollar has dropped sharply against the greenback, predominantly on the stronger dollar move. The US currency was stronger earlier in the year on the expectations the US economy was strong, and the Fed was poised to accelerate the pace of rate increases. The last half of the year, the focus has been on concerns China is slowing, a critical component for the Australian economy, and that trade wars amongst the two largest economies are nowhere near ending.

Poor overnight Chinese data releases

Overnight, industrial output and retail sales misses rose concerns growth is decelerating fast than expected. Industrial output for November came in at 5.4% from a year ago, the slowest pace since early 2016. Retail Sales increased by 8.1% in November but was the weakest print since 2003.

China resumes MLF operations

After skipping the prior 35 open market operations the PBOC did conduct 1-year Medium-Term Lending Facility (MLF). While the injection was mostly to cover up loans that were expiring, many are anticipating action from the PBOC as credit risks rise and economic data continues to disappoint.

All eyes on next week’s 2019 policy road map for China

China has maintained their stance that monetary policy will continue to be supportive, but many are starting to think they will need to do more sooner than expected. Next week, leaders from China will have their annual economic policy-setting meeting. They should outline their priorities, with the specific targets released in March. If China is going to become more active in the markets, we could see a decision to cut the one-year lending rate. The market consensus is for the key rate to be steady throughout 2019, but if we see China wanting to be proactive, they could act very soon.

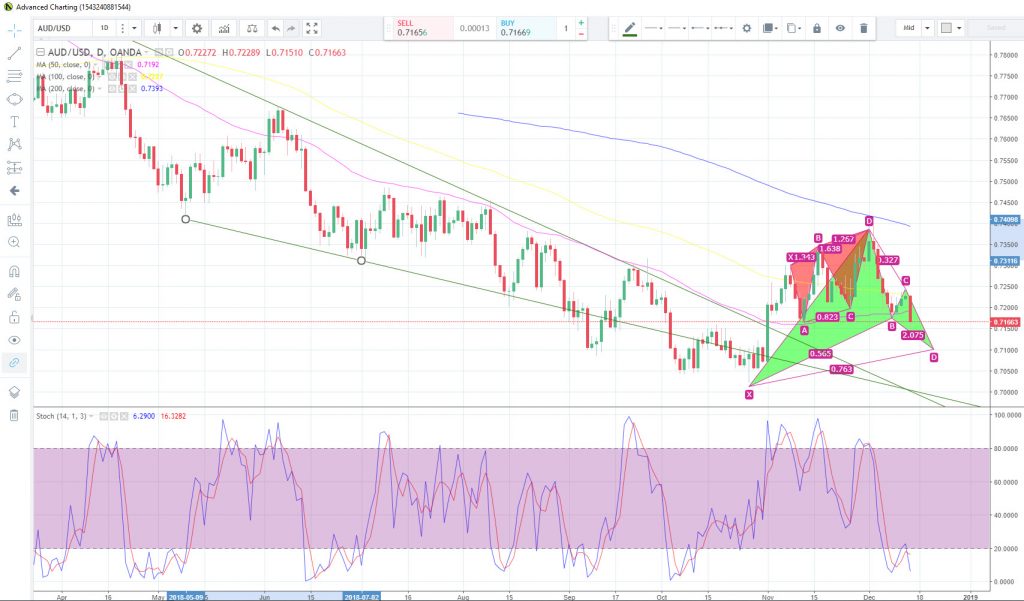

AUD/USD Technical Analysis

Price action on the AUD/USD daily chart shows that today’s drop is tentatively taking the daily candle below the 50-day SMA. If we continue to see commodity currencies under pressure, we could see price target the 0.7100 handle. It is around that area that we could see a bullish Gartley pattern. If valid, we could see a rebound target the 0.7200 region. If the pattern is invalidated, further pressure could target the 2018 low of 0.7020. Major support would come from 2016 low, which is the 0.6826 level

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.