Oil prices rose over 2% early in New York as Libya’s largest oil field remains shutdown and on a positive move in risk appetite as US equities posted a strong start to the session. At the beginning of the week, Libya declared a force majeure at the Sharara oil field with an expected loss of production around 315,000 barrels a day for the OPEC member. The National Oil Company (NOC) noted that production is also in jeopardy at the Zawiya refinery, as it is dependant on the supplies from Sharara. Protestors are demanding better services and healthcare. Libya is no stranger to protests and the upside from this story could be limited.

Oil prices have stabilized as OPEC and allies attempt to re-balance the market. Last week’s decision to cut output by a combined 1.2 million barrels a day supported prices initially, but concerns of a crumbling economic outlook continues to keep any rallies from gaining steam.

The Canadian dollar also benefited from today’s rally in oil prices, but was unable to keep the gains after the US open.

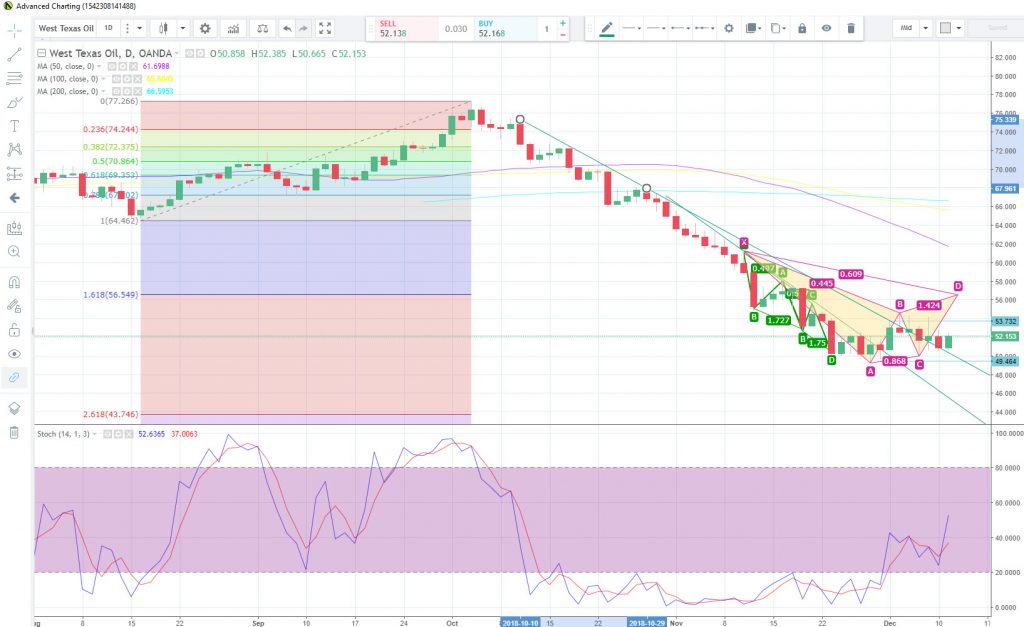

Price action on the West Texas Intermediate daily chart shows that since the November 29th low of $49.41, price has continued to respect the $50 level. If we see prices continue to consolidate here and fail to make a fresh low, we could see a run towards the $54.60 level. Key resistance may come from the $56.20 level, which could also signal the formation of a bearish Gartley pattern. Point D is targeted with the 141.4% Fibonacci expansion level of the B to C leg and the 78.6% Fibonacci retracement of the X to A move. If valid, we could see price attempt to test the $52.00 region.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.