US stocks soared to start the trading week after G-2 (China/US) kick the can down the road on their trade spat. The cease-fire between the US and China helped drive both the US dollar and Treasuries lower. The US will hold off on imposing and an increase of tariffs from 10% to 25% on $200 billion of Chinese goods. The US was promised to see China buy more goods to narrow the trade gap. The 3-month window to negotiate the deal showed a relief for many companies but provided no concrete details on a future framework for a longer-term deal.

This week’s key events and releases for the US

Just after US open, the November ISM PMI reading showed that the overall economy grew for the 115th consecutive month. The November PMI registered a 59.3 reading, an increase of 1.6 percentage points from the October reading of 57.7. New orders also gained 4.7% percentage points, while prices paid fell from October but showed the 33rd consecutive month of higher raw material prices. The reported noted that prices pressure continues, but at notably lower levels than in prior periods.

The US Commerce Department reported U.S. construction spending declined for the third straight month in October. Spending was expected to rise 0.4%, but fell 0.1% to $1.31 trillion. Total private construction fell also below the $1 trillion mark.

Wednesday (Powell testimony to be rescheduled)

US financial markets (NYSE/Nasdaq) will be close on Wednesday, December 5th to honor George Bush, the 41st president of the United States. Fed Chair Powell’s testimony before the Joint Economic Committee, US Senate was also rescheduled. Powell would be expected to maintain his optimism on the US economy, reiterate Fed’s independence to the President, and slight adjustment made last week on the outlook on interest rates. At 8:15 AM ET (13:15 GMT), private payrolls are expected to come in at 197,000, down from 227,000 seen in October, but still a strong sign that hiring is holding up in a tight labor market.

Friday (jobs/wage data)

The US employment report is expected to see gains at around 200,000. The unemployment rate is also expected to stay steady at 3.7%, the lowest level since 1969. Rounding out the data will be average hourly earnings, which are expected to tick higher to 0.3%. The US economy remains on firm footing and strong data prints are still expected to support the Fed’s decision to hike in December.

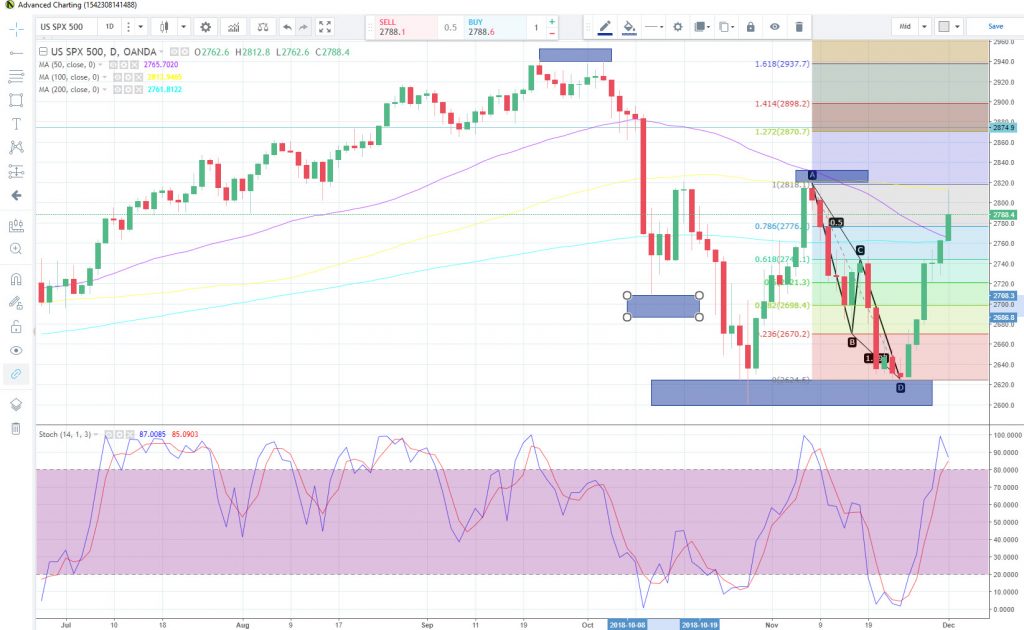

Price action on the S&P 500 daily chart highlights both the key respect of the 100-day SMA and lower highs that have been made since September. Until we see further specifics on China’s concessions and progress on key differences regarding intellectual property and forced technology transfers, we may see stocks struggle to attempt to make fresh record highs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.