Qatar, one of the smallest countries in the world announced Monday, that they will end their 57-year membership to OPEC to focus on natural gas. The departure also was supported by the frustration with Saudi Arabia’s role in leading a blockade that cut diplomatic and trade links with Qatar. The 18-month boycott has led to significant losses, but Qataris have rejoiced their independence from Saudi Arabia.

Qatar’s oil production in October was 609,000 barrels per day in October, or just 1.9% of the total OPEC crude members production. Saad Sherida Al-Kaabi, Qatari Minister of State for Energy Affairs said, “The withdrawal decision reflects Qatar’s desire to focus its efforts on plans to develop and increase its natural gas production.”

Why Qatar leaving OPEC matters

OPEC’s relevance is starting to show some cracks. Qatar is the first Middle Eastern country to leave and other members may view they could be better off out of the organization. Indonesia left in 2009 before returning in 2016. Gabon also returned in 2016 after leaving in 1995.

Qatar has served as important diplomatic go-between for Iran and Venezuela.

OPEC expectations for Dec 6th meeting

At the G20 meeting, President Putin noted they have an agreement with Saudi Arabia, but he could not concrete figures on possible cuts. Last week, the OPEC advisory panel noted that 1.3 million barrels per day production could balance the market. Expectations are currently for a cut between 1.0-1.4 million barrels per day. Even if we see a strong cut, the softening data outside the US will continue to lead falling demand concerns. The EU and China need better prints in order for demand concerns to go away.

Natural Gas

Global demand for liquefied natural gas is rising and some analysts see a shortfall in 2021 and 2022. The rally in global LNG demand stemmed from the Chinese goal of reducing carbon emissions by moving from coal-fire powered plants to natural gas. Many expect 2019 to be a record year for investments in LNG.

US economy

President Trump has been both critical and supportive of Qatar. He supported Saudi Arabia imposing the travel and trade blockade on Qatar, but he also continues to support deals with Doha. Qatar has made firm commitments to make $15 billion in jets from the US. Qatar also is home to the area’s biggest US military base.

Regarding the US economy, any signs of improvement on business capital spending should helpful. This past earning season’s slowdown with investments was expected to roll into the final quarter of the year. Optimism is still strong for 2019 capex to grow and it should benefit from the eventually easing of tariffs from the China/US trade war.

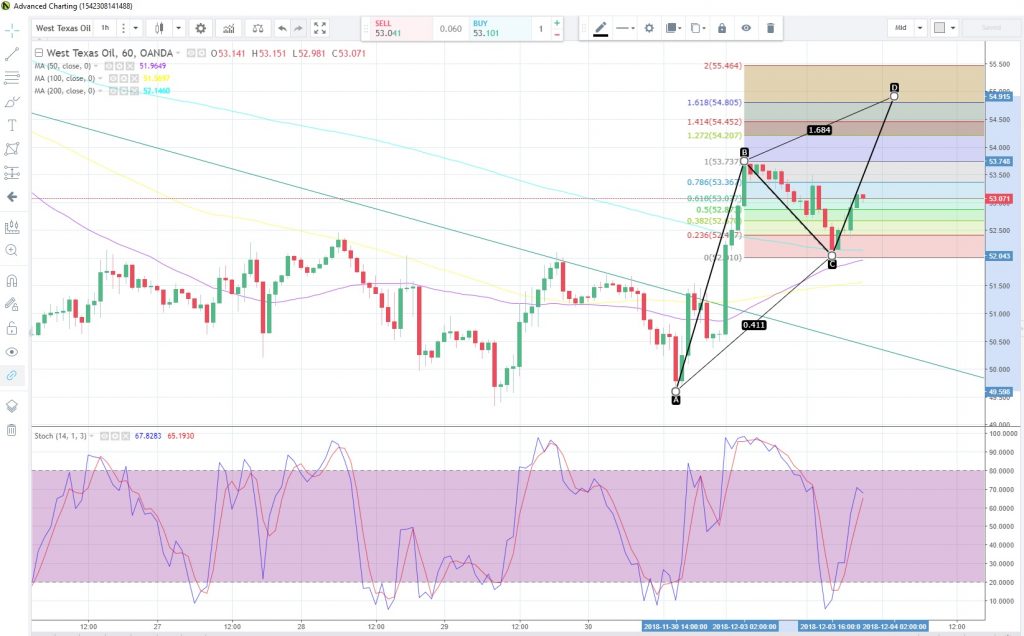

WTI Chart

Price action on the 60-minute West Texas Intermediate crude chart shows the strong start to the trading week found initial resistance at the $54 level. If we see bullish move resume, key resistance may come from the $54.96 level. It is around that area that price could form a bearish ABCD pattern. Point D is targeted with the 161.8% Fibonacci expansion level of the B to C leg. If valid, we could see the longer-term bearish trend target the $52.00 level.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.