Friday November 30: Five things the markets are talking about

Fed Chairman Powell managed to give equities back some of their bid after fine tuning his now less ‘hawkish’ take on the proximity of the Funds rate to neutrality to “just below” from “a long way from.”

There were other dovish hints, reiterating that policy was “not on a pre-set course” and the Fed plans to “pay close attention to the data.” He also downplayed risks in stock valuations, which he didn’t see as excessive.

In Europe, chances of a no-deal Brexit are slim, but uncertainty looms for the pound because the U.K parliament looks unlikely to approve PM Theresa May’s Brexit deal – vote is on Dec 11. Expect the pound to remain vulnerable to any comments or developments that could emerge in the run-up to the vote.

Note: Bank of England (BoE) on Brexit Scenarios: GBP currency could fall -15% in disruptive and -25% in disorderly Brexit.

The U.K Government formally published its parliamentary format for Brexit debate. Debates to be held on Dec. 4th, 5th, 6th, 10th and 11th with up to six amendments selected on the final day. Voting on Brexit debate in U.K Parliament to begin 14:00 ET on Tuesday, Dec 11.

On the commodity front, oil prices continue to remain on the soft side, pressured by a further build in U.S inventories. Fearing a glut, OPEC is considering supply cuts when it next meets on Dec. 6, although some members like Iran are expected to resist any voluntary reductions. Even the Saudis are caught between Trump and needing high oil prices. But, on a positive note, Russia is signaling that a production cut is likely, and a potential boost for crude prices.

On tap: The two-day G20 meeting begins today and concludes on Saturday in Argentina. The main sideshow will be Trumps ‘tete-a-tete’ with Chinese President Xi Jinping. Many are expecting an easing of tensions, rather than any express agreement that involves major concessions from either side on trade.

1. Stocks pared gains

In Japan, Nikkei edged up to a three-week high overnight supported by defensive stocks and energy stocks, but gains were limited as investors brace themselves for the weekend meeting between President Trump and Xi. The Nikkei share average rallied +0.4%, while the broader Topix added +0.5%.

Note: The Nikkei rose +3.3% over the week and +2% for the month, recouping some of October’s -9.1% tumble.

Down-under, Aussie shares were down on weak banks and on market nerves before the G20. The S&P/ASX 200 index closed down -1.6%, after rising +0.6% on Thursday. The index posted its third consecutive monthly loss, losing -2.8% in November. In S. Korea, the Kospi stock index closed lower on Friday, down -0.82%, weighed down by chipmakers and on weaker data out of China. The benchmark index rallied +1.9% on a weekly basis, while it rose +3.3% on a monthly basis.

In China, stocks rallied in thin trading volume, amid caution ahead of the Trump-Xi meeting on the sidelines of the G20 summit in Argentina. The Shanghai Composite index was up +0.8%, gaining +0.3% for the week. The blue-chip CSI300 index was up +1.1%, climbing +0.9% for the week.

In Hong Kong, stocks ended higher overnight as energy stocks, driven by news that oil-producing nations are set to trim supplies, helped lift the market. At the close, the Hang Seng index was up +0.2%, and gained +2.2% for the week. The Hang Seng China Enterprises index rose +0.4% overnight, and was also up +2.2% for the week.

Note: Growth in China’s manufacturing sector stalled for the first time in 24-months in November as new orders shrank. The official Purchasing Managers’ Index (PMI), released overnight, fell to 50, missing market expectations and down from 50.2 in October.

In Europe, regional bourses trade slightly lower across the board following mixed Asian Indices and weaker U.S futures.

U.S stocks are set to open in the ‘red’ (-0.4%).

Indices: Stoxx600 -0.4% at 356.5, FTSE -0.8% at 6985, DAX -0.7% at 11222, CAC-40 -0.5% at 4981, IBEX-35 -0.4% at 9065, FTSE MIB -0.2% at 19121, SMI -0.3% at 8989, S&P 500 Futures -0.4%

2. Oil steady as expected OPEC cuts balance high inventory, gold higher

Oil prices are little changed on market expectations that OPEC and Russia would agree some form of production cut at next week OPEC meeting (Dec 6).

Brent was up +25c at +$59.76 a barrel, while U.S light crude (WTI) was unchanged at +$51.45. Both contracts are up about +1% this week, the first weekly gain in two-months.

Note: Both contracts have had their weakest month in a decade, losing -28% and -30% respectively as global supply has outstripped demand.

Surging oil production in the U.S, Russia and by OPEC has helped fill global inventories and create a glut in some markets.

Next week’s OPEC meeting will be pivotal for global oil prices over the next 12-month. OPEC and Russia are discussing supply cuts and are due to meet on Dec. 6 and 7 to agree production strategy.

Ahead of the U.S open, gold prices remain range-bound overnight as the ‘big’ dollar treads water after President Donald Trump sent mixed signals about the prospects for a trade deal with Beijing on the weekend. Spot gold is up +0.1% to +$1,224.21 per ounce, while U.S gold futures have inched lower at +$1,229.7 an ounce.

3. Yields are a tad lower

Major eurozone government borrowing costs have dipped to their lowest level in three-months this week, on Fed Chair Powell’s comments that many investors saw as a sign the U.S. Fed’s tightening cycle was drawing to a close.

Data showing slightly slowing inflation in Germany and a fall in U.S Treasury yields this week has fuelled a rally in core eurozone sovereign bonds, as investors bet the ECB could be forced to keep rates at record lows for longer.

In Germany, the 10-year Bund yield has declined -1 bps to +0.31%, the lowest yield in more than 14-weeks. In the U.K, the 10-year Gilt yield has declined -2 bps to +1.345%, the lowest in more than three-months, while the yield on 10-year Treasuries decreased -1 bps to +3.02%, the lowest in more than 10-weeks.

Elsewhere, Bank of Korea (BoK) has raised its policy interest rate overnight (+25 bps to +1.75%) for the first time in a year in a widely expected move aimed at containing a boom in the country’s property market. The rate decision was not unanimous; two board members voted to keep rates unchanged.

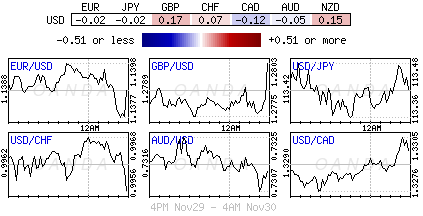

4. Dollar confined to a tight range on month-end

The FX market is currently maintaining tight ranges into month-end, and is awaiting developments out of the weekends G20 meeting being held in Argentina. There appeares to be high hopes on the ‘dinner of the decade’ between Trump and Xi.

Eurozone inflation figures (see below) risk undermining ECB’s Draghi’s rhetoric about “vigorous upward core inflationary pressures.” The EUR/USD (€1.1366) is still finding it difficult to penetrate strong resistance above the psychological €1.14 level.

Sterling (£1.2750, -0.22%) is little changed, but the upcoming vote in parliament (Dec 11) on the Brexit deal negotiated between the U.K. and the EU will mean trading in the pound will be choppy over coming days.

This week’s FOMC minutes confirmed the Fed’s data-dependency, but for now, the ‘big’ dollar is holding its own ground against G7currency pairs.

5. Eurozone core inflation continues to disappoint

The EUR (€1.1366) has edged a tad lower after eurozone-inflation data falls in November. The November consumer price index (CPI) fell to +2% y/y from +2.2% in October.

Market expectations were pointing towards +2%. Core-CPI also fell to +1% from +1.1%.

Eurozone inflation is key for ECB’s monetary policy decisions. The market will be concerned that weak eurozone inflation will pressure the central bank to postpone the first interest-rate increase. For now, the ECB is guiding on a rate rise after the summer of 2019.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.