Santa rally into year-end?

Markets are trading on a more upbeat note after yesterday’s rally, although US futures are slightly in the red on the back of some early profit taking.

There remains a number of very real risk for the markets heading into the end of the year – be it trade wars, higher interest rates, Brexit or Italy, just to name some – but yesterday’s rally will be very encouraging to investors. Stock markets will continue to be vulnerable to negative shocks in the near future but as we head into December, the so-called Santa rally may well be on the cards.

Powell clarifies position after October backlash

The release of the FOMC minutes from earlier this month has been somewhat overshadowed by Chairman Powell’s comments on Wednesday, in which he sought to clarify his position on future interest rate moves. Powell sent markets into a frenzy at the start of October when he claimed “we’re a long way from neutral” and may go beyond, forcing investors to re-evaluate just how many more hikes there’ll be, how soon and how damaging they thought it would be.

While I don’t believe the position of the Fed has changed, I think the attention these comments received – not to mention the criticism he personally has taken – have seen him quickly mature in the role and it will be reflected in his future statements. They clearly highlighted why policy makers go to such lengths to ensure their comments won’t be misinterpreted, something that was evident in yesterday’s remarks.

Traders will now turn their attention to the various pieces of data that will be released prior to the open on Wall Street. US inflation, income and spending numbers will be of interest, all of which are expected to once again paint a healthy picture for the US economy. Inflation continues to hover around the Fed’s target – giving credibility to its policy of tightening in recent years – which income and spending numbers remain strong.

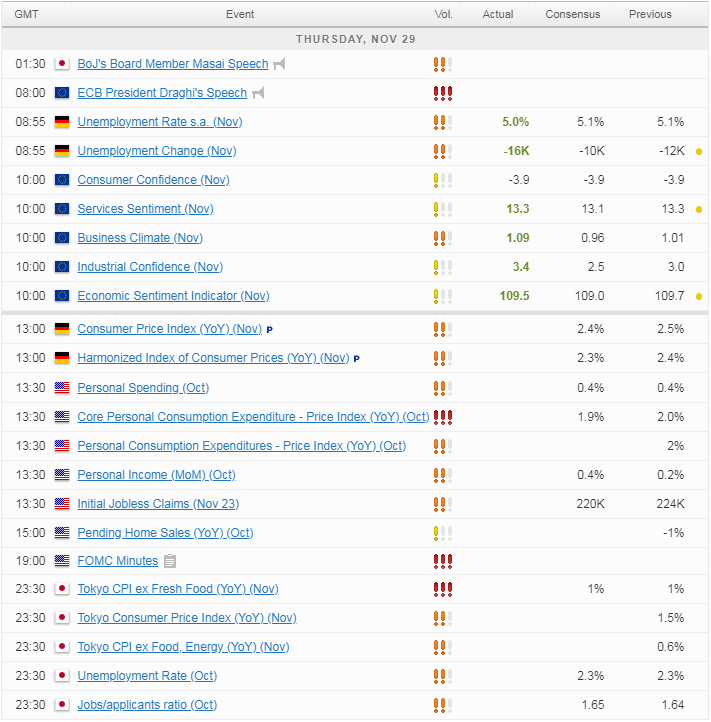

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.