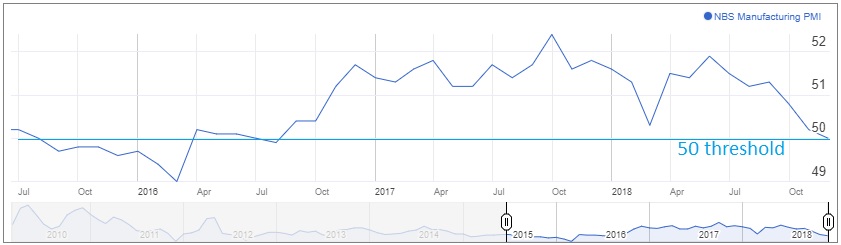

Manufacturing PMI disappoints

China’s manufacturing PMI slid to 50.0 in November, the lowest since July 2016, as the ongoing trade dispute affected sentiment. Forecasts suggested an unchanged reading of 50.2. From a non-manufacturing perspective, the index also came in lower, 53.4 versus 53.8 expected and 53.9 in October.

China Manufacturing PMI – Monthly

The disappointing data took the edge off risk appetite, though not dramatically so, with most equity indices tipping into the red while from a currency perspective, the yen held a bid tone while the Australian and US dollars both drifted lower.

AUD/USD Daily Chart

G-20 wait-and-see

Asian markets were generally on hold after a volatile week, with traders having one eye on the G-20 meeting which starts later today. Reuters noted that China’s state-run newspaper, China Daily, thinks China and the US can reach a trade agreement this weekend, if Washington is “fair-minded”. Even if a deal were struck it was unlikely to be a comprehensive solution to the trade impasse due to “diverging demands and agendas”, the paper added, and we were more likely to see a deal that would prevent a worsening of the current situation, such as a ceasefire in the tit-for-tat tariffs.

Bank of Korea hikes rates

Depend which survey you read, the Bank of Korea either surprised the markets with a rate hike today, or it didn’t. In a survey conducted by Bloomberg, 14 out of 18 respondents forecast a 25 bps hike to 1.75% whereas the MarketPulse calendar indicated a no-change result. This was the second hike in 13 months, the last one being exactly a year ago as the central bank lifted rates from record lows. Despite the hike, the Bank views its policy as still accommodative even as it expects exports to remain favourable and growth to stay as forecast.

Economic data to take a backseat to G-20

The European calendar appears busier than the US one today to close off a busy week. German October retail sales are expected to rebound to +2.7% y/y after September’s slump while UK house prices are seen edging higher this month, according to the Nationwide index. A speech from ECB’s Mersch precedes November consumer prices for the Euro-zone, which are expected to ease off to +2.0% y/y from 2.2%.

Chicago manufacturing PMI for November is the only data of note for the US session, along with a speech from FOMC member John Williams (hawk, voter). Will he tone down his words to match Powell? Or will he stick to a hawkish theme?

The full MarketPulse data calendar is available at https://www.marketpulse.com/economic-events/

Have a great (G-20) weekend from Asia.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.