Trump dampens the mood ahead of G20 meeting

It’s been an encouraging start to the week in financial markets but we got a stark reminder of the challenges that lie ahead late on Monday, as Trump weighed in on trade and Brexit.

Trump’s comments late in the day on Chinese tariffs don’t offer much reason for optimism ahead of his meeting with Xi Jinping on the sidelines of the G20 meeting later this week. These may just be bold statements ahead of the meeting in the hope of pressuring China into a deal but they’re certainly not empty threats. Trump hasn’t been deterred so far and while the final tariffs may cause more harm to the consumer at home, I think he’ll view this as a short-term price worth paying.

The tariffs are seemingly taking their toll on China already, with growth having slipped in the previous quarter and many forecasting that export performance will suffer also, despite the initial boost we’ve seen in the data. Front running of orders ahead of the tariffs being imposed has flattered the data so far but as time goes on, they are likely to take their toll, although the weaker yuan is going to help ease the pain.

Commodities Weekly: Oil tries to find a base after a seven-week rout

Brexit agreement a threat to UK/US deal

Trump also weighed in on Brexit, much to the despair of Theresa May. At a time when the PM is trying to sell her Brexit deal to the UK, Trump conveniently stressed that he believed it was a good deal for the EU that could jeopardise trade with the US. This is a real blow for May given that a trade deal with the US is a key aim for the newly independent United Kingdom. Of course, we should always take these comments with a pinch of salt but that won’t stop her opponents using it against her.

May now has two weeks to sell this deal to the country and, more importantly, the MPs who will vote on it. I think she’s really going to struggle to get is passed at the first time of asking on the 11th December which likely means more turbulence for the currency, which is already coming under pressure as traders become less confident that no deal can and will be avoided. The backstop is a major issue and could be a deal breaker for too many MPs.

Markets are dancing to a more positive beat

Oil slipping again as we await API report

Oil is continuing to look soft ahead of the OPEC+ meeting next week. The API inventory number later on could pile further misery on Brent and WTI if another significant build is reported, although I do once again find myself questioning whether the sell-off is a little overdone under the circumstances. The market seems to be pricing in either no output cut or only a small one, which may leave oil prices prone to a short squeeze.

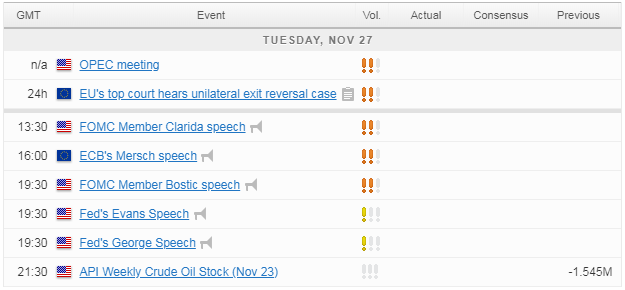

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.