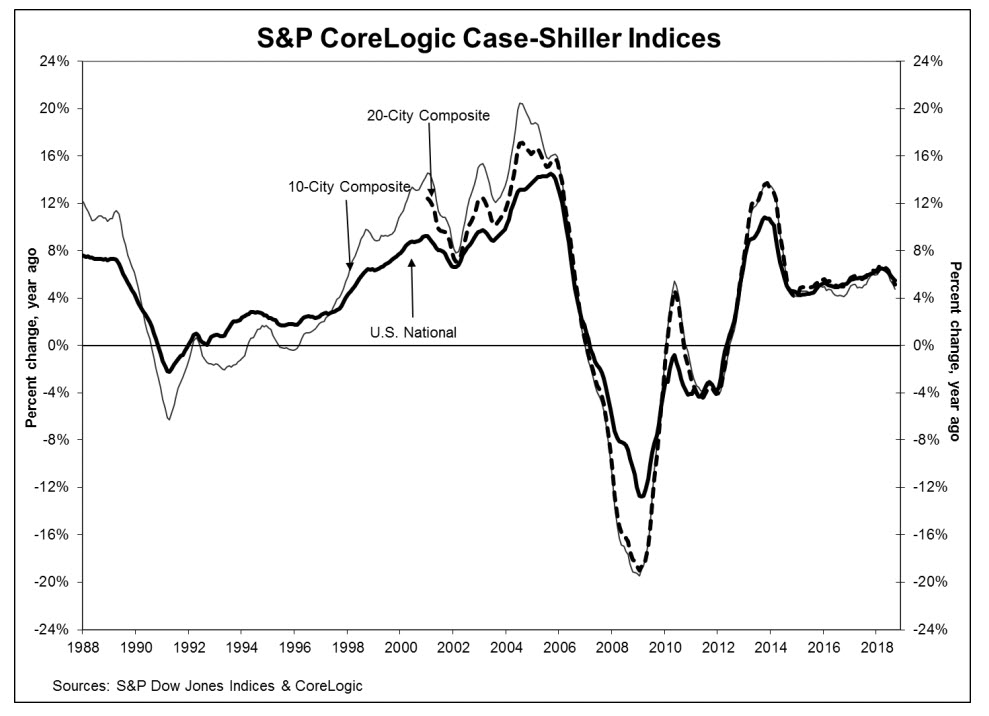

US house prices are still gaining but at the lowest level since January of 2017. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in September, down from 5.7% in August. The report noted that one factor contributing to the weaker housing market is the recent increase in mortgage rates. Currently the national average for a 30-year fixed rate loan is 4.9%, a full percentage point higher than a year ago.

The softer housing price data along with last week’s disappointing NAHB housing market index and declining building permits and housing starts data confirm the continuing trend of a slowdown in housing.

Price action on the 60-minute USD/CHF shows that recent bullish channel has been in place since the middle of last week is finding tentative resistance from the parity level. If bullishness accelerates, major resistance will come from the November 13th high of 1.0127. To the downside, key support will come from the 0.9820-0.9890 region.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.