The global rout in equities continued early in New York as technology, retailers and energy stocks and risk assets continue to get repriced. The US dollar also rallied along with Treasuries, as the yield on the 10-year fell to the lowest level since September. Risk aversion momentum continued as concerns grow on the global slowdown in economic growth, tighter fiscal conditions, fading US fiscal stimulus and trade wars.

The CNBC Global CFO Council survey was released and showed 51.4% of CFO’s expect the Dow Jones to fall below 23,000 before reaching the 27,000 level. 35.1% of the CFO’s were unsure what would happen first and 13.5% expect it to cross 27,000 level first.

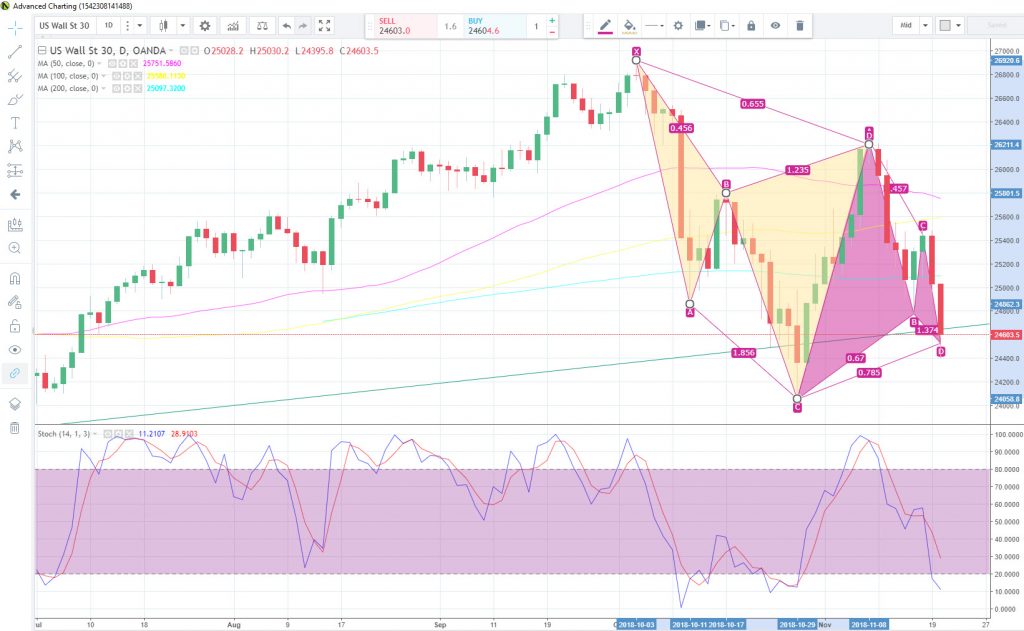

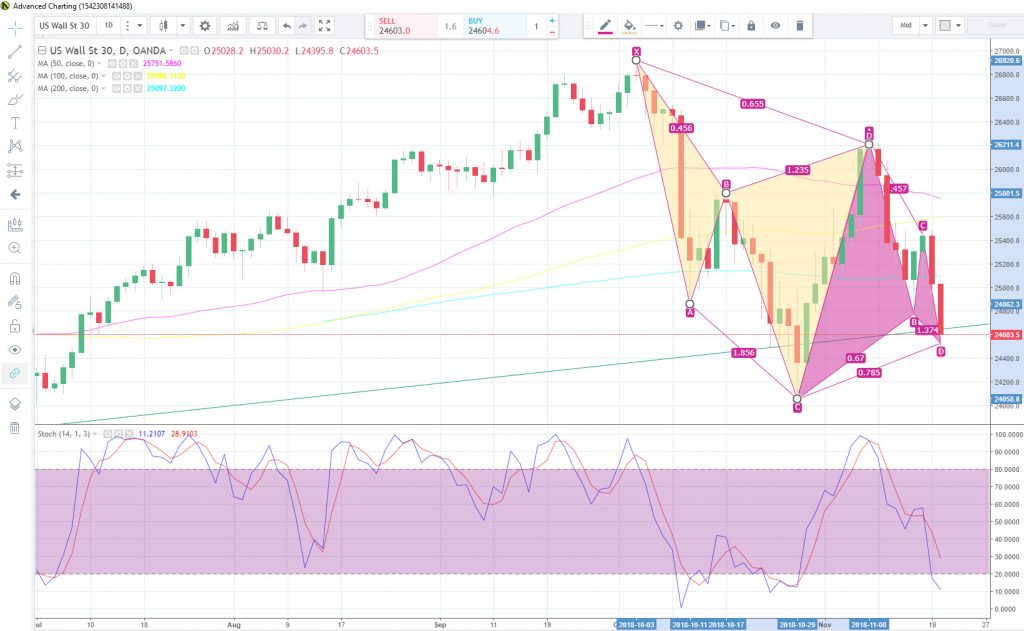

What is typically a quiet holiday week has seen volatility surge as the VIX jumped over 12% and moved closer to the October 11th high. Geo-political risks will likely keep the markets moving as Brexit headlines will be plentiful and EU will respond to the submitted budgets, with the focus on Italy. The Dow Jones Industrial Average did tentatively respect the 24,400 and potentially formed a bullish Gartley pattern. Point D is targeted with the 78.6% Fibonacci retracement level of the X to A leg and the 141.4% Fibonacci expansion level of the B to C move.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.