Daily Markets Broadcast

2018-11-19

Wall Street extends rebound in late buying

A weaker start on Friday was overcome late in the session and Wall Street extended Thursday’s rebound. Brexit was at centre stage for European bourses, with Theresa May still UK Prime Minister, for now. Oil prices rose for a third day.

US30USD Daily Chart

-

The US30 index extended gains to a second day on Friday, on hopes for improvements in US-China trade negotiations

-

The index is currently sandwiched between the 200-day moving average at 25,101 and the 100-day moving average at 25,587

-

Friday’s gains may be short-lived after US-China relations soured at the weekend. US VP Pence said the U.S. wasn’t in a rush to end the trade war, and would “not change course until China changes its ways”. US index futures are pointing to a lower open.

DE30EUR Daily Chart

-

The Germany30 index struggled on Friday as Brexit headlines weakened sentiment. UK PM May’s leadership could be challenged early this week

-

The index hit the lowest this month before rebounding, but still closed in the red on Friday, recording the second down-week in a row. The 55-day moving average at 11,823 could act as a resistance point

-

Euro-zone current account balance for September is due today. August’s surplus was EUR20.5 billion.

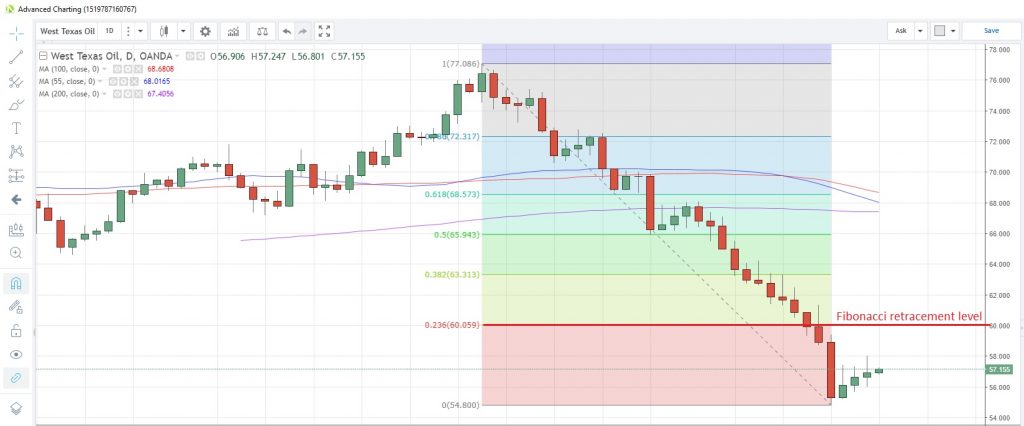

WTICOUSD Daily Chart

-

Crude prices rallied for a third day on Friday, but not enough to climb into positive territory for the week. That meant oil prices have fallen for six straight weeks

-

The 200-week moving average lends support at $51.95 with resistance possible at $60.06, the 23.6% Fibonacci retracement of the Oct3 to Nov13 drop

-

OPEC ministers will meet on December 6 in Vienna to decide on production policy for the next six months amid a growing surplus in world markets.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.