Wage growth meets expectations

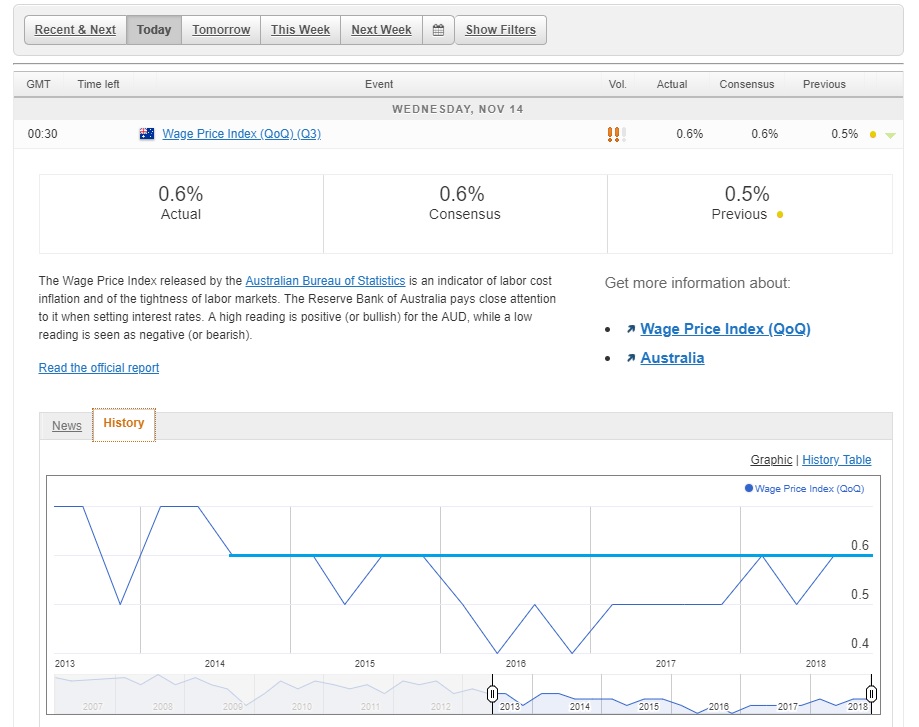

In line with expectations in last week’s RBA Statement on Monetary Policy, Australian Q3 wages grew at a faster pace than in the second quarter, according to data released today. Wages growth was +0.6% q/q, surpassing the previous quarter’s pace of +0.5% q/q, and equaling the highest since the second quarter of 2014. It is assumed that higher wage pressures will in turn filter through into higher inflation numbers, a prerequisite for the RBA to start to consider adjusting policy.

Australia Wages Growth Q/Q

The Aussie slid across the board with AUD/USD touching 0.7214 and AUD/JPY dropping to 82.14. The 55- and 200-hour moving averages are converging around the 82.10 level. The impact of the wages data was felt more in equity markets, with the Australia200 index tumbling more than 1.4% to the lowest level this month, extending declines to a fourth day.

AUD/JPY Hourly Chart

Japan economy stutters

The Japanese economy contracted for the first time in three quarters in Q3. Growth fell 0.3% q/q and 1.2% y/y. Estimates had anticipated a negative reading, but the annualized one was worse than forecast. Economy Minister Motegi commented that the contraction was due to a fall in exports and some temporary factors, including a hit to consumption from natural disasters. The Japan 225 index took the data in its stride, currently up 0.5% on the day, helped by gains in the auto sector after news emerged that the US may be holding off on implementing auto tariffs for now. USD/JPY was marginally higher at 113.93.

There’s significant risk ahead

China data mixed

There was something for both bulls and bears in today’s China data. Industrial production rose more than expected in October, advancing 5.9% y/y versus forecasts of a 5.7% gain. On the other hand, retail sales were weaker, gaining just 8.6% y/y, well below estimates of 9.1% and the slowest pace of growth in five months. Tipping the scales in favour of the bulls, fixed asset investment rose 5.7% y/y year-to-date, the biggest gain since June.

USD/CNH rebounded off intra-day lows after the data, rising to 6.9535 from 6.9463, but has now drifted back below 6.95. China shares were also under pressure, dropping almost 1% on the day.

US consumer prices to headline

The major event for today’s data calendar will no doubt be the release of US consumer price data for October. Forecasts suggest a boost of 0.3% m/m and 2.5% y/y, both above September’s rates and, if matched, would affirm the Fed’s current trajectory for interest rates into next year.

Ahead of the US data we see the slew of UK numbers. CPI, RPI and PPI for October are all due, with retail and consumer prices seen rising but both input and output producer prices are expected show slower gains. The revision of Euro-zone Q3 GDP data is not expected to result in any changes to previous estimates of +1.7% y/y and +0.2% q/q.

Speeches from Fed’s Quarles and Powell complete the session.

The full MarketPulse data calendar can be viewed at https://www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.