Markets pare post-election gains

The post-election bounce was strong but short-lived, with US futures slightly in the red ahead of the open as traders turn their attention to today’s central bank announcement.

The first of the week’s two major risk events – from a US perspective – may have passed without any disruption but there’s still one more to come before investors can fully relax. The feared blue tsunami turned out to be more of a shallow wave, which investors are more than content with. Rather than contemplating a possible reversal of tax cuts, we’re weighing up the prospect of infrastructure spending which has bipartisan support; it’s no wonder we saw a relief rally on Wednesday.

Fed next, EUR and GBP struggle

Will Fed soften hawkish rhetoric?

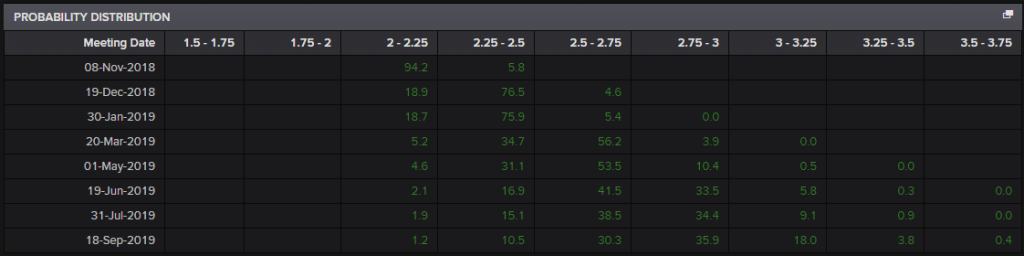

The Fed meeting was always the lesser of the two risks but investors will still be following it extremely closely. Interest rates remaining unchanged is almost an inevitability but the statement that follows will be poured over for any indication that recent market volatility has in any way softened plans for hikes this year and next.

It was Jerome Powell that appeared to be the catalyst for the recent stock market sell-off when he suggested that interest rates were not close to neutral and could become restrictive, which got investors worried about the economic ramifications of such a move. The Fed may seek to clarify this in the statement today, although given the lack of a press conference I wonder whether they will instead hold off and see if the situation settles down on its own.

Fed Interest Rate Probabilities

Source – Thomson Reuters Eikon

It would make much more sense, given the recovery we’ve seen in the market, for the Fed to address the interest rate path in December when it is widely expected to raise again. This would give them the opportunity to clarify anything in the press conference that follows and lay out clear plans, alongside the dot plot, for the coming years. Instead today it may just emphasise the cautious and gradual approach to rate hikes.

DAX – Wall street gains fails to boost DAX, Fed rate decision next

Oil stages recovery on OPEC+ output cut speculation

Oil is staging a small recovery today with Brent and WTI trading around 1% higher ahead of the weekend meeting of OPEC+ in Abu Dhabi this weekend. There has been suggestions that the group could cut production again next year in an attempt to rebalance the market, with inventories rising once again and oil prices dropping 20% in a month. The decision to grant temporary waivers to eight countries that import Iranian crude has been partly attributed to the drop, while rising inventories and US production is also contributing to the shift in sentiment towards oil.

Oil (WTI and Brent) Daily Chart

OANDA fxTrade Advanced Charting Platform

Gold edging lower on stronger dollar

Gold is edging lower again on Thursday, coming under a little pressure as risk appetite continues to grow and the US dollar creeps up. The declines we’re seeing in the yellow metal are only small though and underlying sentiment towards it seems to remain positive. The US dollar may be holding up for now but I’m not convinced that will last much longer which could be supportive for Gold, especially if it’s combined with a slight softening of the hawkish Fed rhetoric.

Gold Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.