Investors remain risk averse as multiple concerns weigh

Relatively flat sessions across much of Asia and some weakness in Europe on Wednesday is taking its toll on US futures ahead of the open on Wall Street.

There are a number of worries for investors right now, from the pace of rising bond yields and the impact on investor sentiment, to Italy’s populist coalition playing a game of chicken with the European Commission, stalling Brexit negotiations and the ongoing trade conflict between the US and China. This is all taking its toll on investors and while the US may have recently scaled record highs, supported in a major way by tax reforms passed late last year and the economic fallout from them, others are not faring as well and the longer it goes on, the more it’s likely to catch up with Trump as well.

No one getting too excited despite increasingly positive Brexit reports

The UK is very much in the spotlight this morning, following reports that progress has been made on the Irish border. While traders are yet to get too excited about the prospect of significant progress despite the fact that we are now a week away from the EU summit, at which leaders had previously hoped to have a deal in place to sign off on. It’s been a long time since this was seen as a realistic target but time is running out and at the next summit in November, the pressure will be significantly higher to have an agreement in place or no deal Brexit is going to become increasingly likely.

It does seem over the last 24 hours that reports have been becoming more positive, which has been reflected in the currency but we’re yet to hear anything of substance and fatigue may be setting in from all of the vague and at times, unfounded, claims that’s keep filtering out. There does seem to be something more to the more recent comments but traders are being patient, for now.

European open – Brexit reports provide early lift

UK economy flat lines in August

Sterling has been paring gains since the start of the European session and the raft of UK data hasn’t done anything to put a floor under it. GDP data for August was a little disappointing as the economy didn’t grow following a bumper month in July. It would appear the consumer buzz from the unusually good summer and World Cup has worn off, which was to be expected at a time when the consumer is feeling the squeeze following a period of negative wage growth. The July data was revised higher though which offset the disappointment from the August data.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Other figures released alongside the GDP data were a little better with manufacturing and industrial production data exceeding expectations on the month, while numbers for July were also revised higher. Unfortunately, accounting for such a small portion of the economy, this failed to get traders too excited and instead we just saw a collective shrug of the shoulders. As has been the case for some time, politics is driving markets right now and the data just doesn’t have the sway it once did.

Pound extends gains on Brexit noise

Oil slightly lower as Hurricane Michael upgraded

Oil markets remain a particular point of interest having recently risen to 2014 levels and threatening to go higher. It has lost some of its spark over the last week as traders lock in some profits but we’re not yet seeing much appetite for lower prices. With Iranian sanctions coming next month and Hurricane Michael – following its upgrade to category four – threatening some near-term output in the US, the bulls may still feel pretty confident.

The IMF’s warnings on global growth on Tuesday may also have weighed a little but broadly speaking, I think few were surprised at the lower revisions given the environment we currently find ourselves in.

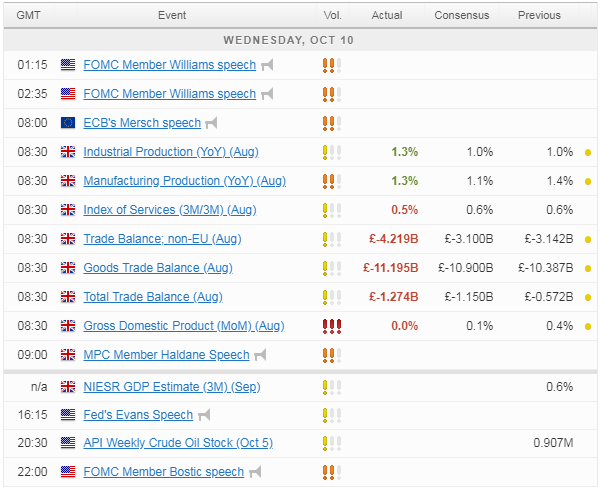

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.