Markets lower as we head towards quiet US session

A bank holiday in the US and Canada on Monday should ensure we see thin trade at the start of the week, with news flow and economic releases from that side of the pond also likely being fairly muted.

Of course we can never account for the Presidents Twitter account which has the ability to cause a wobble all on its own but broadly speaking things are expected to be very quiet. US markets are open but trade is expected to be very thin, while futures are pointing lower again as the recent rise in bond yields weigh on riskier investments.

I don’t expect this sell-off to last too long and think it’s more a symptom of the aggressiveness of the yield rises, as opposed to real concerns about the prospect for stocks and the economy in a higher interest rate environment. The rise in US yields which has prompted a similar increase in the US dollar – which continues to push higher this morning – was initially triggered by a flurry of strong economic indicators and hawkish comments from Federal Reserve Chairman Jerome Powell and the move still appears to have some legs.

Muted response to PBOC’s liquidity easing move

China takes a hit after week holiday

The decline in US futures this morning is also likely being aided by sell-offs in Asia and Europe at the start of the week. Chinese stocks have been shocked back to life after the week long holiday, with the Shanghai Composite ending its first day back almost 4% lower, on the back of last week’s broad declines and despite the 100 basis point reserve requirement ratio (RRR) cut, intended to support the economy in the face of a trade war with the US.

The cut to the RRR will likely only draw increased criticism from the US, who has accused the country of manipulating its currency to keep it artificially weak. The cut though has not weakened the currency too much although it does continue to creep slowly towards the seven handle against the dollar that many traders view as being psychologically significant.

Asia market update: riding the risk roller coaster

Italian fiscal concerns drag on Europe

The sell-off in Asia may have been enough to weigh on risk appetite in Europe but as it turns out it doesn’t need much help, with the coalition Italian government’s determination to collide with Brussels over its budget plans causing more than enough of a stir in the region. Italian 10-year yields have spiked again today with the spread between it and Germany’s surging above 300 basis points and to the highest in five years.

This is also taking its toll on Italian equity markets which are clearly leading the losses today, with banks taking a bit hit in the process due to the still close links between the two. Italy hasn’t been the only casualty though, with the rest of Europe being caught up in the losses and Greece in particular being drawn into the firing line, with it seen as being among the most vulnerable to renewed aversion to European debt markets.

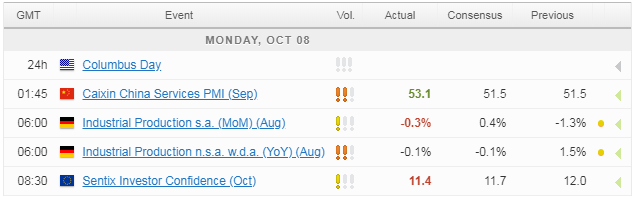

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.