Officials hopeful of NAFTA deal today

This week may come to be remembered as one in which countries in North America re-committed trade ties to one another but as ever, this hasn’t been the only story rattling financial markets and not all have been as positive.

Hopes of a trilateral deal by the self-imposed deadline of today have greatly improved as the week has progressed and negotiators from the US and Canada will once again lock horns in the coming hours with the aim of getting it over the line, or risk delaying it for many more months.

Both sides have sounded optimistic that any differences can be resolved and end months of disputes over the terms of the 24-year old trade deal which US President Donald Trump has long threatened to pull the plug on. An agreement would mark a significant step forward in trade relations with the US and its trade partners and be sold to the electorate as validation of Trump’s hard line approach ahead of the mid-terms which doesn’t necessarily bode well for the countries other trading partners who are currently engaged in negotiations.

EUR/USD – Euro steady as Eurozone CPI estimate close to estimate

Trump not easing up on EU or China and threatens to pull out of WTO

China and the European Union have been the other two major targets for Trump, who has accused both of taking advantage of the US on trade. Reports that Trump has rejected an offer from the EU to remove car tariffs on both sides suggests these talks have much further to run, despite the apparent positive meeting between the President and European Commission President Jean-Claude Juncker last month.

Relations with China are much worse, with Trump reported to be ready to back another $200 billion of tariffs as early as next week which would be met with retaliation and further escalate the conflict between the two superpowers. With Trump also threatening to pull out of the WTO, this could well be viewed as a step backwards for global trade despite the progress on NAFTA.

Trump trade talk hurts stocks and EM currencies

Emerging markets remain a risk as Argentina central bank hikes rates to 60%

Trump may not be at the centre of the other story rattling confidence in markets right now, being the sell-off in emerging market currencies, most notably the Argentinian peso, but higher interest rates in the US and the impact that’s had on the dollar has clearly contributed to it.

At the moment, the focus has primarily been on those countries that are the biggest risks, including Argentina where interest rates yesterday rose to 60% in an attempt to slow or stop the plunge in the peso. Others are feeling some pain though and investors will certainly keep a close eye on developments here should the situation continue to deteriorate.

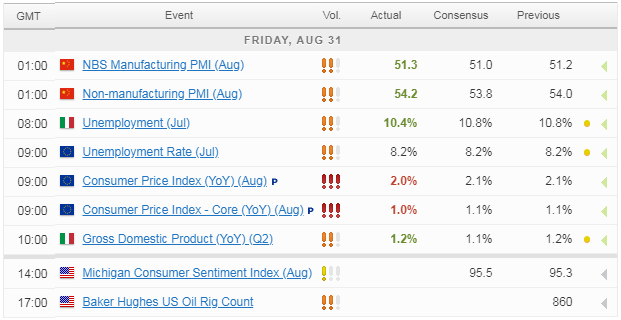

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.