August Fed minutes in focus today

Central banks are back in focus as we head into the second half of the week, with the Federal Reserve minutes being released on Wednesday ahead of the Jackson Hole symposium over the coming days.

While the minutes could pass with little impact due to the clear and transparent nature of the Fed interest rate tightening cycle right now, traders will still pour over the release and look for any clues that the pace could pick up further or could be persuaded to slow down. While I think the latter is unlikely given the strength of the US economy at the moment, US President Donald Trump’s comments recently are clearly intended to put pressure on central bankers and it’s not the first time he’s made them.

Trump has stressed his apparent belief that the Fed should be helping his cause not hindering it, taking aim at the pace at which it is raising interest rates which threatens to slow the potential of the economy and further strengthen the dollar. While I don’t expect Trump’s comments to influence policy makers – and they shouldn’t – it’s clear that they now have a target on their back and will be publicly attacked should the economy not hit the heights that Trump promised.

DAX climbs to 1-week high, investors eye US-China trade talks

Powell Jackson Hole appearance eyed after Trump comments

There has been speculation of intervention following the repeated focus from the Trump administration on the dollar which has provided some relief for the greenback in recent days. Trump’s attacks on others, not only his own central bank, with respect to manipulation suggests it’s going to remain a focus of his and as long as that is the case, this speculation isn’t going to go away.

While the Fed minutes are the immediate focus, traders will be more interested in policy makers views later in the week, particularly those of Jerome Powell who was picked by Trump to lead the central bank and is clearly at the forefront of his criticism. I expect Powell to maintain the central bank’s line given the continued performance of the economy and avoid being swayed by Trump’s comments or being drawn into discussing the actions of other central banks.

Trumps legal woes are markets center of attention

Trump doubtful on progress in negotiations with China

Trump seems to be at the centre of everything right now, with other stories of interest to traders being the start of negotiations between the US and China on trade following the recent imposition of tariffs and threats of many more. The President has stressed that his expectations ahead of the meeting are low but we have heard this before. With mid-terms around the corner, a win in negotiations here could be extremely timely.

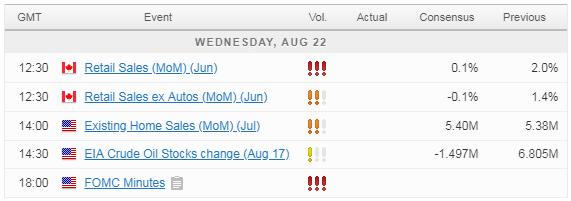

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.