Aussie leader losing support

The Australian dollar kicked off the week with a weaker bias as the beleaguered prime minister appears to be losing the leadership. Following a spate of cabinet resignations, markets are bracing for a second leadership challenge in a week. The uncertainty, and possibility of a general election, has pressured the AUD across the board, with AUD/USD sliding to its lowest level this week. The pair is currently trading at 0.72875 after touching 0.7283 and remains capped by the 55-day moving average at 0.7397, with support at the August 15 low of 0.7202.

AUD/USD Daily Chart

US, China sit down at the negotiating table

Both parties sit at the negotiating table for the first time since June as China is scheduled to impose retaliatory tariffs on $16 billion worth of US imports today. US President Donald Trump has already said that he is not optimistic of any result from this meeting while a senior central bank official stated that a competitive devaluation of the yuan would not be used as a tool to combat the trade frictions.

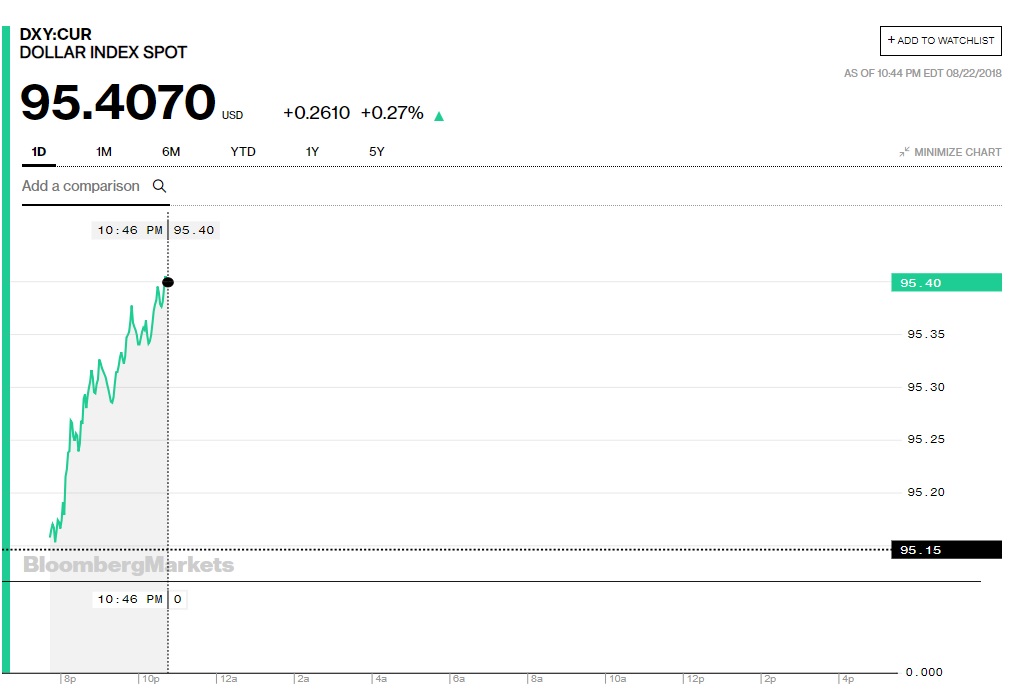

Meanwhile, Moody’s has said that US-China trade relations are expected to decline this year which will have a damping effect on growth in 2019. The US dollar is firmer against the US’ 10 major trading counterpart currencies this morning, rising for the first day in seven.

Dollar Index Intra-day Chart

Focus on Jackson Hole

The Kansas City Fed’s Jackson Hole Symposium kicks off today with the main event being Fed chairman Powell’s speech at 14:00 GMT tomorrow. Fed minutes of the August 1 meeting released overnight said many officials viewed another increase “soon” to be appropriate. Markets are already assigning a 92% chance of a September hike, while the minutes suggested the committee may do more if the strong economic expansion stays on track. This brings the December meeting into play, with markets pricing a 57% chance of another move higher.

Today’s calendar slate includes Markit PMI readings for Germany, the Euro-zone and the US along with the minutes of the last ECB meeting.

The full MarketPulse data calendar is available at: https://www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.