Trade war fears remain

Financial markets are once again in risk aversion mode on Wednesday, as investors continue to take shelter from the ongoing trade spat.

There hasn’t been much progress – positive or negative – in recent days although US Treasury Secretary Steve Mnuchin did deny reports that the country is looking to block investment from China in US tech, instead claiming there will be a statement aimed at all countries trying to steal technology. Given related comments from the Trump administration, it would be safe to assume this primarily targets China but clearly there is a desire to involve others as well.

While this appears to neither escalate nor de-escalate the trade dispute the US is raising with a number of countries, it is yet another reminder that Trump is not softening his stance and instead continuing to double down on efforts to pressure countries into submission, something that does not appear to be working yet. There is clearly still a long way to go so traders should get used to the hostile and potentially risky environment we now find ourselves in.

Stocks decline on trade worries; oil rallies

The question is whether markets will respond as they often do, which is to be very sensitive to early exchanges before becoming less susceptible to verbal threats and tit-for-tat exchanges. With US futures in the red and European markets trading with a slightly negative tone, we’re clearly not there yet, although the Dow is still just under 4% from this year’s low, the S&P 500 just under 8% and the Nasdaq only a week ago hit a new record high.

Dow Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil edges higher ahead of EIA release

Oil is continuing to climb in European trade after a US state department official claimed they are pushing allies to cut oil imports from Iran to zero. This comes at a time when supply disruptions in some countries such including Venezuela is already weighing on output. Last week, OPEC and some non-OPEC producers that participated in the 1.8 million barrel a day output cut in recent years agreed to pump an extra million barrels a day, something traders appear to feel will be difficult to achieve.

Brent and WTI Crude Daily Charts

API also reported a 9.228 million barrel draw down in inventories on Tuesday which is the biggest drop since January and, if confirmed by EIA today, would far exceed expectations and be the biggest decline we’ve seen since September 2016. This could provide further support to Brent and WTI crude which are once again quite elevated and not trading far from their recent highs, despite the agreement last week.

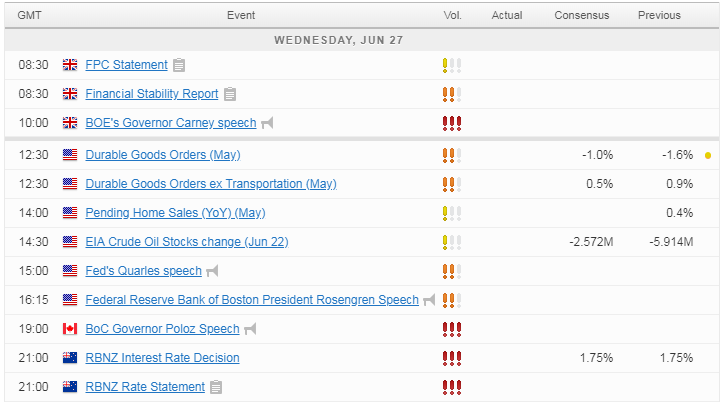

Also being released today is durable goods orders and pending home sales. There’s also appearances from more Federal Reserve officials, including Randal Quarles – a permanent voter on the FOMC – and Eric Rosengren – a voter next year.

Yuan feels pressure as trade spat continues

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.