Investors remain concerned about trade war prospects

US futures are in the red again ahead of the open on Tuesday, with the ongoing trade spats between the US and others continuing to weigh.

While there haven’t been any major developments in the last 24 hours, nothing we’ve heard recently fills investors with any confidence that we’re going to see a de-escalation any time soon. With tariffs already being implemented and US President Donald Trump promising more in retaliation against the European Union and China, it seems the situation is going to get much worse before it improves.

As it stands, it’s difficult to determine just what impact recent events will have on the economies of those involved, not to mention just how much worse the situation is going to get. What’s clear though is that it’s weighing heavily on risk appetite and if Trump keeps doubling down on his threats against the US trade partners, it could seriously take its toll. Given how closely Trump watches the markets, it will be interesting to see whether he changes his approach if the recent declines continue.

Yen stays bid despite better risk sentiment

USD rallying as risk aversion drives safe havens higher

The dollar is continuing to be one of the biggest beneficiaries of the safe haven shift, with US 10-year Treasury yields creeping back below 2.9%. The greenback had pared its gains over the last week but it appears to be back on the ascent, with the euro having run into resistance around 1.17 against it. The pair has run into significant support around 1.15 on a couple of occasions over the last month, so could be a decent test of it should we slip back to those levels again.

EURUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

The pound is also coming under pressure again today, having rotated off the 1.33 level. While the dollar appears to be the main driver here, it is also seeing weakness against other safe haven currencies, such as the yen. Moreover, with Brexit negotiations seemingly making little progress, the recent boost from the Bank of England’s hawkish turn has proved to be short-lived.

GBPUSD Daily Chart

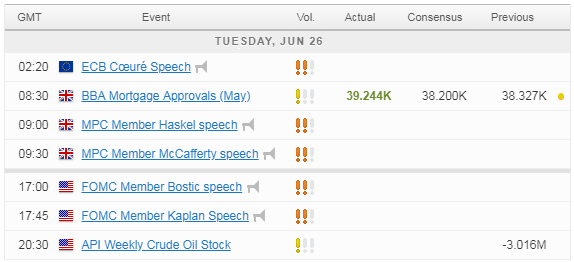

The economic calendar is looking a little thin again on Tuesday, with US consumer confidence and API crude inventories the only notable releases. We will also hear from a number of central bankers throughout the day including Federal Reserve officials Raphael Bostic and Robert Kaplan.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.