Caution Remains Even as Initial Concern Passes

Financial markets have settled down again on Thursday following another flare up a day earlier when US President Donald Trump threatened retaliation against Syrian use of chemical weapons.

Markets were already in slight risk averse mode ahead of the Tweet from the US President, with the trade conflict with China continue to drag on risk appetite, but the announcement triggered another drop which indices only marginally managed to recover from. Ahead of the open on Wall Street, futures are posting gains over around one tenth of one percent, only a small percentage of the losses suffered on Wednesday.

With a possible trade war and conflict with Russia over Syria on the horizon, it’s no wonder investors aren’t feeling particularly bullish right now. That said, I still believe the chances of either – yet alone both – actually materializing are relatively slim which may stop the sell-off in equities getting out of hand.

Dollar Gains Limited by Geopolitical Risks

Fed Minutes Confirm More Hawkish Stance

The Federal Reserve minutes on Wednesday offered relatively new of note although they do appear to have given some support to the dollar in the near-term. It’s not surprising to see that policy makers were feeling increasingly hawkish, given the revisions to rate, inflation and growth forecasts, or that they were cautious about the impact a trade war could have on the economy.

It would appear the central bank has laid the groundwork for another rate hike in June which would leave them six months to implement the third that is forecast and also leave room for a fourth if it’s deemed necessary by the data in the interim. That may be providing some relief for the greenback in the near-term but it’s really struggling to gather any upward momentum, although at least the sell-off has temporarily stalled in recent months.

Middle East Embers Look Set to Ignite

ECB Minutes, Carney Speech and US Jobless Claims on the Agenda Today

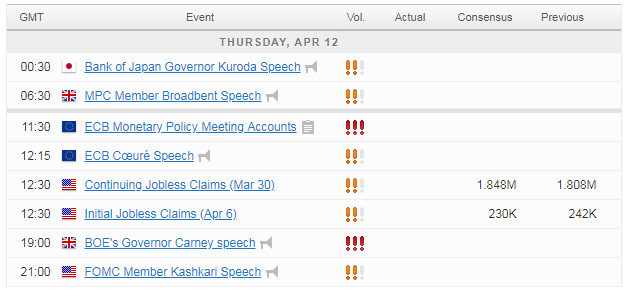

We have one of the quieter agenda’s on the cards today, with the only economic release in the US being the weekly jobless claims report. We will also get the minutes from the recent ECB meeting, although I don’t expect much to come from these that we don’t already know, with the central bank likely using one of the upcoming meetings to hint at what to expect post-September. Bank of England Governor Mark Carney will speak later on which will be of interest given the expectation that they will raise interest rates in May.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.