Investors Anxious About Pace of Tightening and Trade Wars

US futures are coming under pressure once again ahead of the open on Thursday, as investors continue to display an anxiety about the path of interest rates against a backdrop of escalating trade conflicts.

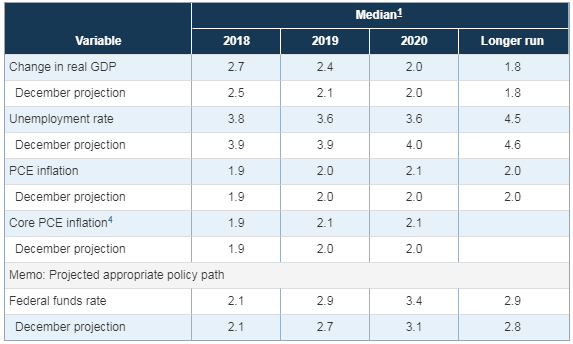

The Federal Reserve announcement on Wednesday went, broadly speaking, as many anticipated with the central bank raising growth and inflation forecasts and, with that, expectations for interest rates in the coming years. While the central bank still only expects three rate hikes this year, an extra is now forecast for next year and it’s expected to reach 3.4% in 2020, up from 3.1% in December.

Fed Economic Projections

Source – Federal Reserve Website

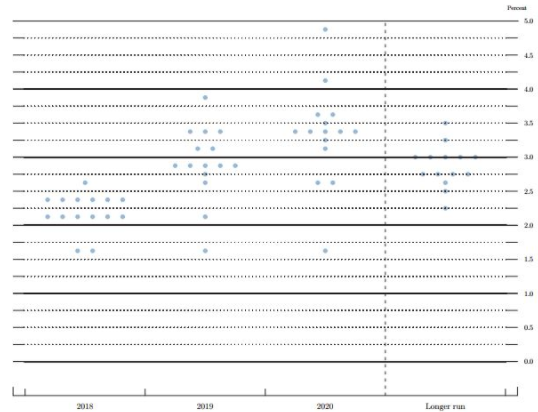

Fed Dot Plot

Source – CNBC

This faster pace of tightening is primarily being driven by the fiscal stimulus from tax reforms which were passed late last year. There was plenty of debate about whether this was necessary and while markets responded positively at the time – likely driven largely by corporation tax changes – we’re now seeing the negative impact, with investors fearing the impact more rate hikes could have on the wider economy.

Risk Appetite Fades ahead of Trump Chinese Tariff Announcement

On top of that, Donald Trump seems intent on starting trade wars, most notably with China, which could trigger a wave of protectionism and drive up prices in the US and likely weigh on the growth momentum. How the central bank deals with this will be very interesting given the already fast pace of hikes. Policy makers may well be feeling very happy with the decision to get ahead of the curve with tightening as it affords them the ability to maintain gradual hikes now.

BoE Expected to Signal May Rate Hike Today

On the other side of the pond, attention will be on the Bank of England monetary policy decision, as it prepares to raise interest rates from post-financial crisis emergency levels for the first time in nine years. The rate hike towards the end of last year was simply a reverse of the post-Brexit referendum cut a year earlier, taking the rate back to 0.5% where it had spent the seven and a half years previously.

While a rate hike is not expected today, it is heavily priced in for May when the central bank will also release its inflation report containing new macro-economic projections. The Monetary Policy Committee has become notably more hawkish recently and the reference to rate hikes needing to come “somewhat earlier and by a somewhat greater extent” than it expected in November, last month was a clear reference to an upcoming meeting. If the MPC is still planning to raise in May, I would expect another clear hint from the central bank today.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.