Trump’s Tariffs Weigh on Global Stock Markets

US President Donald Trump’s protectionist trade measures announced on Thursday is the latest thing to take its toll on stock markets, with indices in Europe heavily in the red and US futures pointing to another tough session on Wall Street.

Trump has long been accused of prioritising protectionist populist measures over those that will benefit both domestic and global growth, something he has repeatedly dismissed, claiming the measures being considered were aimed at making trade fair and reciprocal. He may be able to persuade his core voter base of that but investors are far from convinced, as was evident by the market reaction to the announcement.

This move isn’t only bad for steel and aluminium producers, protectionist measures such as tariffs are bad for everyone who’s costs have now increased, which impacts companies and end consumers. And these measures are unlikely to be a unique case, other countries will now consider counter-measures against the US which won’t necessarily target this particular sector.

EUR/USD – Euro Climbs as Trump Talks Tariffs

The announcement has also come at a time when investors sentiment is already fragile, with markets having been rocked by the prospect of more aggressive monetary tightening, which Trump is already partially responsible for after passing the tax reform measures late last year. For someone so obsessed with stock market performance, he’s taking a big gamble with these tariff’s, the benefits of which are questionable.

May Speech in Focus as EU Pushes For Progress in Talks

The timing of Trump’s tariffs could work in the favour of the UK as it pushes the EU for a free trade deal that promotes cooperation and brings down protectionist barriers. Theresa May’s speech today will be monitored closely as she seeks to pick up the pace of negotiations and bridge the gap between the two sides.

As ever, I’m sceptical that the speech will contain anything of substance having heard numerous speeches over the last 18 months and given the tough position May finds herself in, shackled by Brexiteers on her cabinet and with only a slim working majority in parliament. Another Florence speech moment is what people are hoping for today but I’m neither convinced by the potential for it or that it was as significant as was made out.

Italian Election and German Coalition Vote Eyed Over the Weekend

Finally, European investors will have an eye on Italy and Germany ahead of a massive weekend for both countries. The election in Italy on Sunday is likely to result in a hung parliament and months of coalition talks while Germans will be hoping they’re at the end of that process with the SPD voting on whether to go into coalition again with Angela Merkels centre right block.

Both of these events do hold the potential to shake markets at the open next week. A stronger than expected performance for anti-EU parties in Italy or a failure to pass the vote for a coalition among the SPD – likely meaning more elections – could create instability just as the region looks to be getting back on its feet.

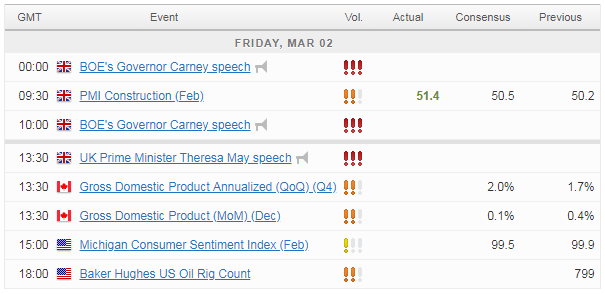

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.