Europe Poised For Decent Start After Week of Consolidation

European equity markets are set to open around half a percentage point higher on Monday, taking a lead from Asia where markets also got the week off to a strong start.

This follows a week in which markets steadied themselves after a very volatile start to the month. Investors were left shocked earlier this month when stock markets went into a sudden tailspin, shedding more than 10% in a week and sending the VIX to levels not seen in more than two years in the process.

Higher inflation and interest rate expectations were blamed for the sharp sell-off following some more hawkish commentary from central banks and stronger economic data. While the situation has since settled down a lot and volatility has returned back to more normal levels, stocks remain around 5% off their highs in the US, more in Europe, while rates are not far from their recent highs.

FTSE 100 (UK100) Daily Chart

OANDA fxTrade Advanced Charting Platform

Draghi, Powell and Carney Speeches in Focus This Week

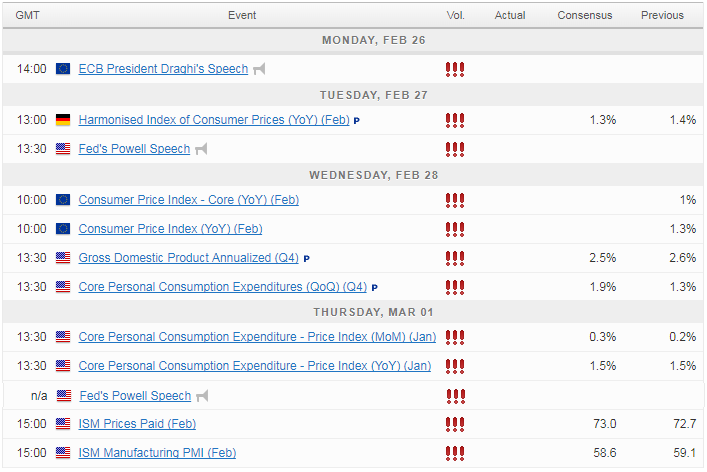

This should make the week ahead all the more interesting as inflation figures will be released for the US and eurozone and we’ll also hear from a number of central bankers including the heads of the Federal Reserve, European Central Bank and Bank of England. ECB President Mario Draghi will get things underway on Monday with his appearance before the European Parliament this afternoon.

The ECB has long been preparing the markets for the end of bond buying and recent statements, minutes and comments from Draghi himself have indicated that the central bank intends to give plenty of warning of upcoming changes leading many to expect such a warning in the not too distant future. Draghi may therefore drop further hints on the timing of such a policy shift in today’s hearing which the euro will be particularly sensitive to.

Draghi will be followed later in the week by an appearance from BoE Governor Mark Carney who used his appearance in last week’s inflation reporting hearing to reaffirm the central banks desire to raise interest rates this year. The one not to miss this week though will be new Fed Chair Jerome Powell’s appearances before the House Financial Services Committee (Tuesday) and Senate Banking Committee (Thursday) as he lays out his plans for interest rates this year and beyond and we learn whether the central bank under his leadership will differ from that of Yellen’s.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.