Eurozone Manufacturers Still Extremely Bullish Despite Stronger Euro

It’s been a positive start to trading on the first day of the month, with markets in Europe trading well in the green and US futures ticking a little higher as well.

It’s been a busy morning of economic releases and broadly speaking, the data is very positive for the eurozone economy. The region carried some strong momentum into the new year and the latest manufacturing PMIs suggest confidence in the recovery is showing no signs of faltering. The survey for the region as a whole remained at 59.6, slightly shy of last month’s high of 60.1 while still signalling a strong growth outlook for the sector.

The weak euro has played a big role in the strong performance of the sector which has led many to speculate about whether its resurgence over the last year will hinder output going forward. The survey’s we’re seeing suggest manufacturers are not particularly concerned at this stage and are continuing to see strong demand, despite the 20% increase in the value of the euro over the dollar over the last year. The rise against the pound has been far more modest though.

OANDA fxTrade Advanced Charting Platform

UK PMI Slips But Sterling Continues Push Higher

The UK data has been less encouraging as of late and the manufacturing PMI for January was no different, slipping to 55.3 from 56.2 in December. The sector has actually benefited in the post-Brexit world, with the sterling depreciation driving more demand for UK manufactured goods. Unfortunately, it still remains a very small part of the UK economy and the boost seems to be wearing off.

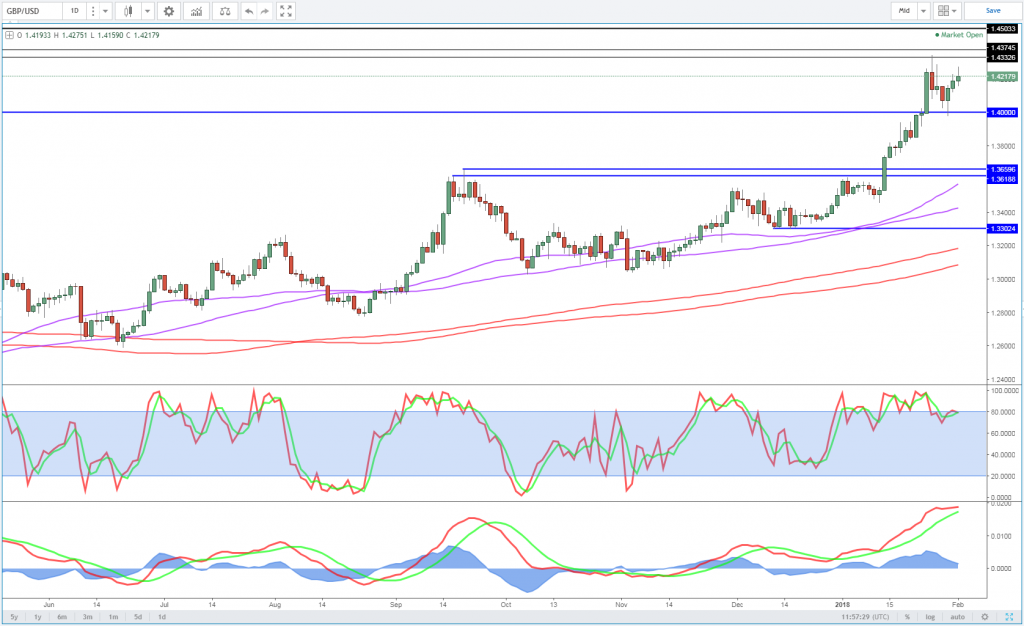

That said, a weaker PMI number this morning did little to shake the pound which is heading back to last week’s highs against the dollar. Cable now finds itself back it pre-Brexit territory, although much of this can be attributed to the greenbacks decline over the last year. The pair found some resistance around 1.4350 but there’s clearly still some bullish appetite there. A break through here could see the pair testing 1.45, which isn’t a million miles from the 2016 highs.

US Data Eyed as Optimistic Fed Fails to Lift the Greenback

The dollar is continuing to have a rough time, even a more optimistic sounding Fed did little to lift the greenback which continues to languish around three year lows. Yields on near-term US debt have risen in the aftermath of the Fed statement, with a rate hike in March now almost entirely priced in and a further two this year around 65% priced in. This would typically be positive for the dollar any gains were short-lived.

There’s plenty more data still to come today, with two manufacturing PMIs from the US as well as unit labour costs, non-farm productivity and jobless claims. Earnings season remains a key focus for investors and some big names are due to report after the close on Thursday, including Amazon, Apple and Alphabet.

Bitcoin Below $10,000 and Looking Vulnerable

Bitcoin is coming under pressure once again today and is trading back below $10,000, a level that has proven difficult to hold below. It’s currently trading down more than 5% on the day though and should we close below here, it could be yet another bearish signal for the cryptocurrency which is already more than 50% below its peak.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.