US Futures Recover After Worrying Sell-Off on Tuesday

US investors were left feeling a little anxious on Tuesday after indices wiped out the strong gains seen at the open to end the day a little lower, but these worries may be quickly alleviated with futures pointing to another positive open on Wednesday.

There were some concerns on Tuesday that the prospect of a government shutdown may rattle the markets, with Congress appearing no closer to finding a solution, but I’m not convinced that investors are overly worried at this moment in time. In the past, the can has either been kicked down the road late in the day or shortly after the shutdown begins and right now I don’t see any reason to believe this will be any different.

I think investors are far more concerned with earnings season, both in terms of whether companies lived up to high expectations going into the season and the projected benefits of Donald Trump’s tax reforms. It’s this that will determine whether stock markets can continue the remarkable run they’ve been on, more so than how long it takes government to reach a budget agreement or pass a temporary spending bill.

DAX Dips as Eurozone Final CPI Edges Lower

BoC Rate Hike Almost Fully Priced in

The Bank of Canada will meet on Wednesday and is expected to raise interest rates for the third time in six months having not raised once in the almost 10 years prior to this.

Market Implied BoC Interest Rate vs Actual

Source – Thomson Reuters Eikon

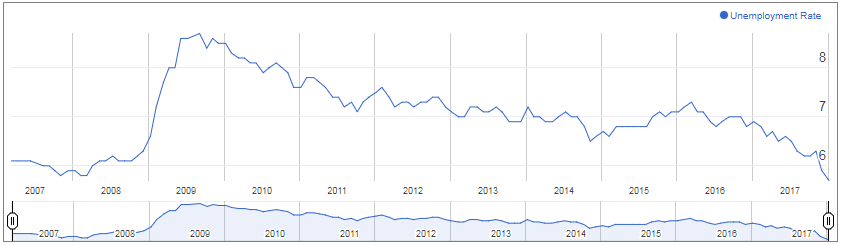

It was generally accepted that the BoC would raise interest rates a couple of times this year having done so twice in 2017 and warned of further tightening but it was the December jobs report that appeared to seal the deal this month, as unemployment fell from 5.9% to 5.7% despite expectations of a small increase.

Canadian Unemployment Rate

While some may question the central bank’s decision to raise interest rates again so quickly given concerns about household debt and the impact that raising rates so quickly could have, markets see little chance of it not going ahead with it, pricing it any more than 90% with a further two this year. With today’s hike priced in so heavily, the Canadian dollar could come under some serious pressure if the central bank holds off for more evidence of a significant tightening of the labour market given that inflation remains low.

Is the Market Too Aggressive on a BoC slam-dunk rate hike?

Bitcoin Tests $10,000 as Speculators Abandon Ship

Bitcoin is coming under substantial selling pressure once again on Wednesday, falling below $10,000 at once stage, taking the losses to around 50% in the last month. While $10,000 even two months ago would have been seen as a huge success for Bitcoin enthusiasts, the euphoria towards the back end of 2017 saw prices sky rocketing on a daily basis driving many to claim it was in dangerous bubble territory.

Bitcoin (CME) Daily Chart

While that in itself doesn’t mean bitcoin will crash and burn, the warnings have proven to be legitimate in recent weeks. The question now is how long it will take bitcoin – as well as other cryptocurrencies that have had an equally awful month, some worse – to find its feet again. There was clearly a significant speculative component to the rally late last year and the drop will be very discouraging to those that previously thought there was easy money to be made. The recovery, once it begins, will likely be very gradual in comparison the what we saw in November and December. For now, it’s just a question of how low it will go, with $10,000 currently providing some reprieve.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.