Another Quiet Holiday Session Lined Up

US equity markets are poised to open a little higher on Thursday after making marginal gains a day earlier in light trade.

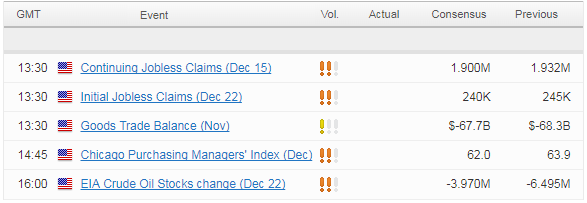

It’s likely to be another relatively quiet day, as is often the case during the holiday period, and a lack of economic events on the calendar won’t help matters. There is a few pieces of data scheduled for release, although its mostly low and medium tier data, including jobless claims, Chicago PMI and trade balance figures. We’ll also get crude inventories data, as oil continues to trade near its highs with WTI pushing $60.

Daily Brent and WTI Crude Charts

OANDA fxTrade Advanced Charting Platform

USD Under Pressure Again on Lower US Yields

The US dollar is trading lower for a second day on Thursday, still struggling after yields on Treasuries slipped on Wednesday. The flattening of the yield curve has triggered concerns that investors are possibly pricing in a slowing of the economy or even a recession and while this has historically happened on such expectations, I’m not convinced this is the case this time.

EUR/USD – Euro Pushes Towards 1.20, Markets Eye German CPI

Given the current environment, it’s possible that this is more a reflection of longer term interest rates and the low inflation environment than the economic prospects. Still, if yields on long term US debt don’t rise or even fall as the Fed raises interest rates, it could fuel fears of an impending recession.

Bitcoin Tumbles as Tough Holiday Period Continues

Bitcoin is coming under selling pressure once again, with efforts by South Korean authorities to rein in speculation being blamed for the drop of around 10%. While this is likely a contributing factor, I wonder if given the pre-holiday drop, whether speculators have become more sensitive to negative news.

Daily Bitcoin Chart

Source – Thomson Reuters Eikon

We saw plenty of this in reverse on the way up, with positive news triggering significant rises and negative news being brushed aside. It wouldn’t surprise me if we see prices heading back below $10,000 before they find their feet again.

Last Licks for the Dollar Bears

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.