US Seen Higher as Congress Prepares to Vote on Tax Reform Bill

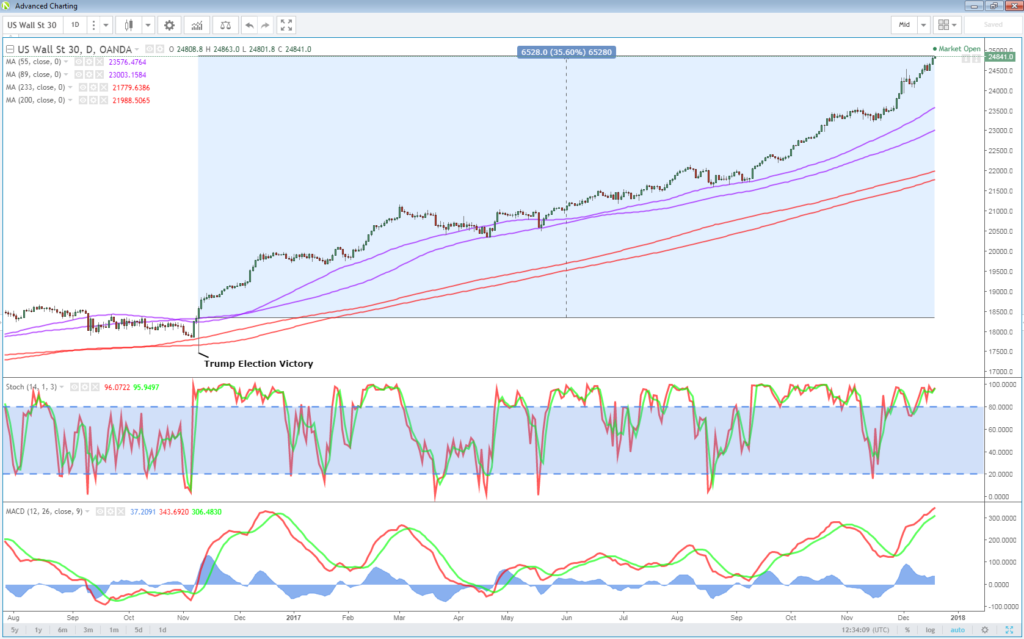

US equity markets are on course to open higher again on Friday, once again pushing for new record highs as tax reform edges ever closer.

Tax reform was one of the key initiatives that contributed to Donald Trump’s election victory last year as he vowed to revitalise a sluggish US economy. While it may have taken longer to deliver than he expected, it would appear that Republicans determination to give Americans an early Christmas present has paid off, although there has been numerous debates about who actually stands to benefit most from the bill.

Markets have clearly benefited from the prospect of tax reform over the last 13 months and the Santa rally that we’ve seen in the run up to Christmas is another reflection of that. It will be interesting to see if this will be maintained for the rest of the week or whether it becomes a “buy the rumour, sell the fact” scenario.

OANDA fxTrade Advanced Charting Platform

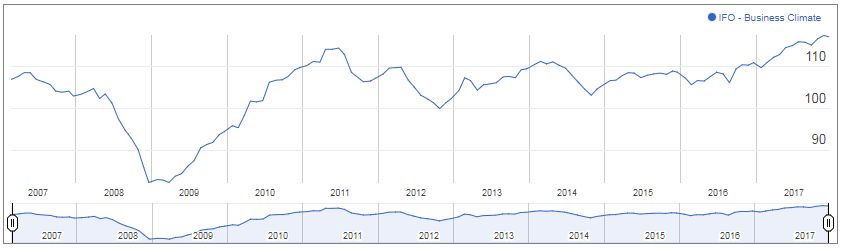

German Ifo Eases From Highs But EUR Rallies Anyway

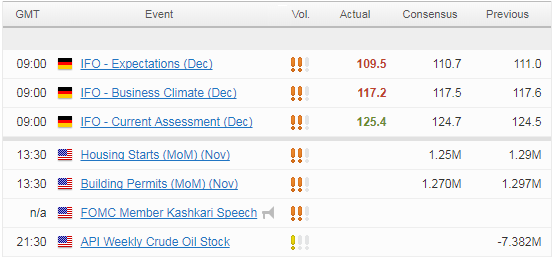

Tax reform aside, there are a number of data releases that traders will be closely monitoring this week. The German Ifo business climate was this morning initially weighed on the euro before the currency rebounded to become one of the standout performers today. The number fell slightly short of expectations – falling from record highs to 117.2 – although the current assessment component equalled its record at 125.4, making the initial response to the release a little over the top.

Still to come from the US we’ll get building permits and housing starts and we’ll also hear from Neel Kashkari, who’s time as a voter on the FOMC expires at the end of this year. The only other notable release today will be API crude inventories, which comes as oil continues to trade around its highest level in the last couple of years.

Bitcoin Spending a Rare Day in the Red

Bitcoin is having a rare day in the red on Tuesday, paring excessive gains that came as CBOE and CME prepared to launch futures contracts. The move – which was seen by advocates of the cryptocurrency as legitimising it – drove the price up more than 50% over the last couple of weeks before settling a little over the last couple of days, clearly only by its own standards.

It’s possible that the 3-4% declines being seen this morning is just some profit taking as Bitcoin prepares to overcome another milestone – $20,000 – only weeks after having overcome $10,000 for the first time. It’s difficult to say what will trigger the next wave of frenzied buying in Bitcoin, assuming it will happen of course, but I don’t expect things to settle down too much any time soon.

Stock Bulls Take the Lead, Dollar Keeps Calm

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.