A pipeline fracture in the North Sea will be bringing smiles to OPEC today, increasing their production by 25.0% for the near future with no effort on their part.

It isn’t often that a hairline fracture is regarded as good news, but in the case of Brent Crude, it was. Brent Crude raced higher by 2.0% overnight as news broke that the North Sea’s Forties Pipeline system would have to be shut down for a “number of weeks” after a hairline crack was found in it. The pipeline carries 450,000 bpd or 40.0% of the U.K. North Sea’s production and is a significant component underpinning of the Brent benchmark.

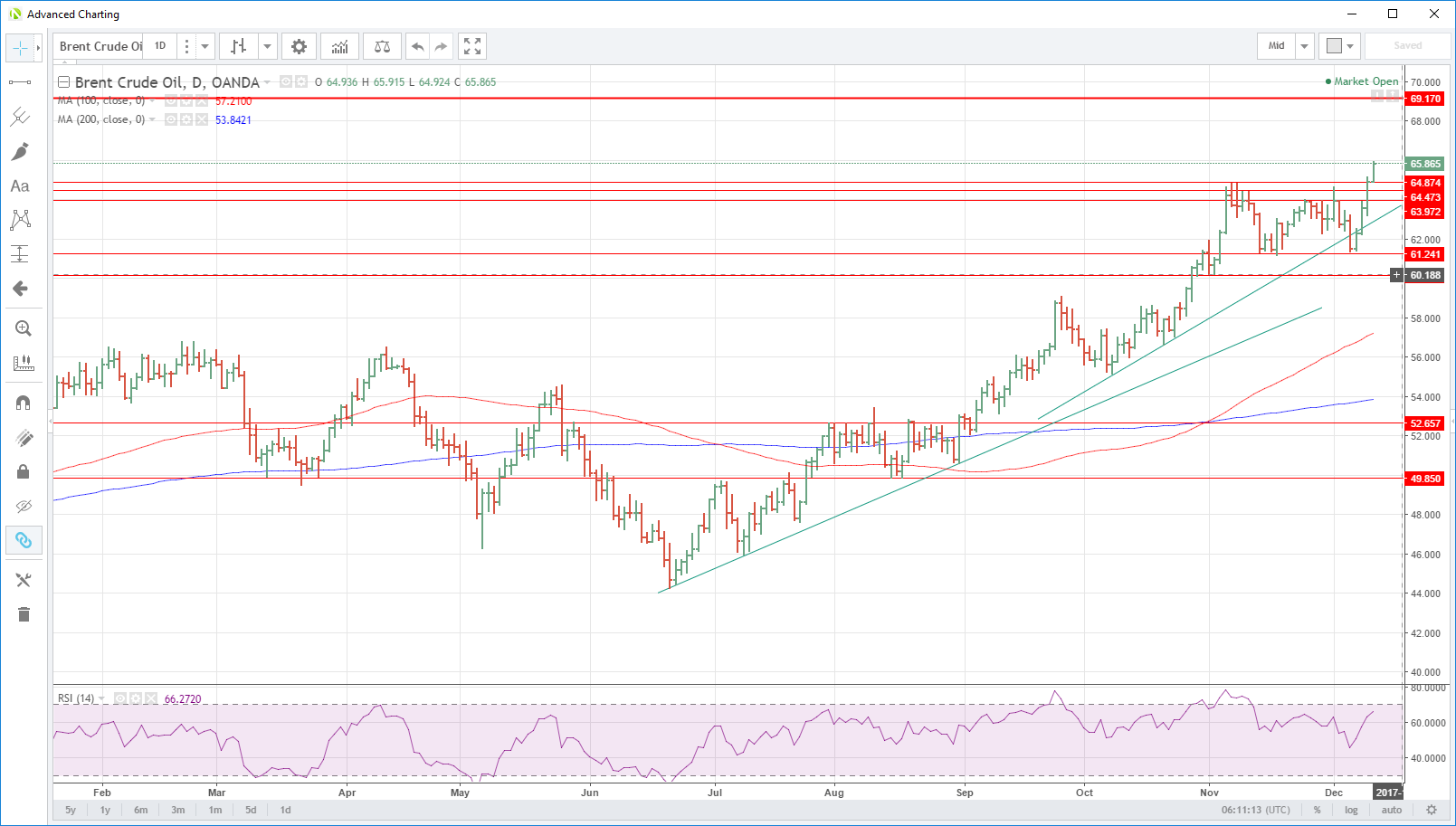

Brent Crude raced from 63.55 to close at 64.95 having touched 65.10 during the session. It has since climbed another 1.50% to 66.05. Far more significantly, it has taken out three formidable resistance zones at 64.00, 64.45 and 64.85 which all now become support. Initial resistance was at the overnight high after which the charts have nothing but clear sky until 69.50/70.00 region. The pipeline’s closure is effectively adding 450,000 bpd to OPEC/Non-OPEC’s 1.80 million bpd cut and thus it’s significance to the global supply/demand situation should not be underestimated.

WTI also benefited, not least because the U.K will be scrambling to find alternative supplies with 80 North Sea platforms to all intents out of action. WTI spot was dragged 1.20% higher to touch 58.00 before settling just below at 57.95. It has climbed 0.45% in Asia to 58.35. The 58.00 level was also significant as it is also trend-line resistance, with a break opening up a challenge of the 58.90 triple top, the last rampart standing in the way of a test of 60.00.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.