European Futures Track Asia and US Declines

European equity markets are expected to open a little lower on Tuesday following a softer session in Asia, which came as US equity markets took a negative turn after posting fresh record highs at the open.

AUD Lifted By Retail Sales Data and RBA Statement

There was plenty of movement in the Australian dollar overnight as stronger retail sales data for October followed by a slightly more hawkish tone from the Reserve Bank of Australia lifted the currency around 0.7% against the greenback. The growth in consumer spending is the highest we’ve seen since May and comfortably exceeded expectations, while the September reading was also revised higher.

AUDUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

While the data was largely responsible for the Aussie move overnight, the RBAs reference to a tighter labour market did appear to push the currency a little further. That said, while we are seeing progress, the probability of a rate hike any time soon appears slim and the post announcement move was probably largely aided by the momentum gathered in the aftermath of the retail sales release. The RBA left rates unchanged at today’s meeting.

The Pound Trades Like an Old Beach Roller Coaster

China Gets PMI Releases Off to a Positive Start

The Caixin services PMI rose more than expected overnight, which follows a similar bounce in the official reading last week. As has been expected, we are seeing a dip in the surveys in the latter part of the year and yet they are showing some resilience despite the fact that stimulus efforts have been reined in.

Improvements in the global economic environment will be going some way to filling this gap and should continue to aid the transition in China for the foreseeable future.

Irish Border Issues Preventing Progress in Brexit Negotiations

There’s plenty more services PMI surveys being released across Europe this morning, although many of these will be revised readings and may therefore have little impact. The UK reading is expected to ease off a little from October but remain elevated at 55.

This comes as negotiations between the UK and the EU appear to finally be making some progress. The two sides still have a little further to go before they can proceed onto the next stage and discuss future trade but there appears to be a more optimistic feeling that this can be achieved before the deadline in just over a week. The pound has already rallied in anticipation of a deal on the financial settlement and citizens’ rights although as ever complications, this time around the Irish border, are preventing these being wrapped up just yet.

Gold Slips as Factory Orders Beats Estimate

Tax Reform Remains Key For US Investors

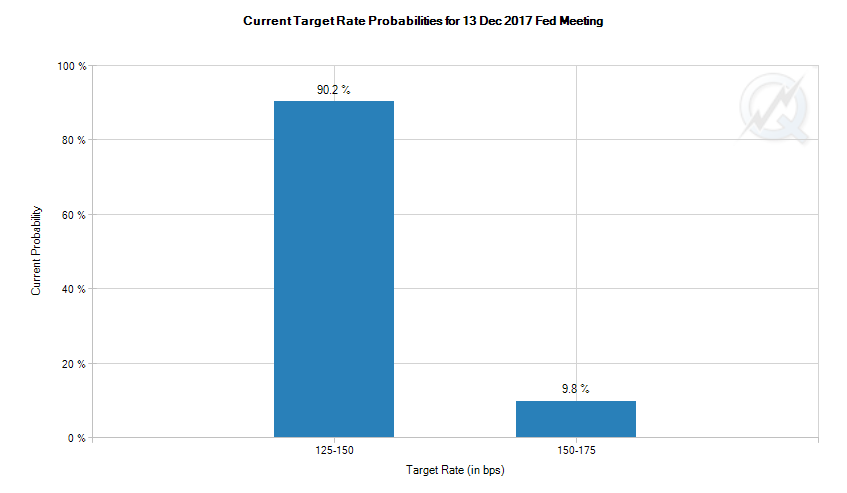

The passage of tax reform through Congress will likely be the key focus for US investors between now and year-end, with a rate hike this month almost entirely priced in. While these discussions take place though there is plenty of data to keep an eye on including of course this Friday’s jobs report. Today it’s the ISM non-manufacturing PMI that will steal the focus, as well as the services PMI reading, both for November.

Source – CME Group FedWatch Tool

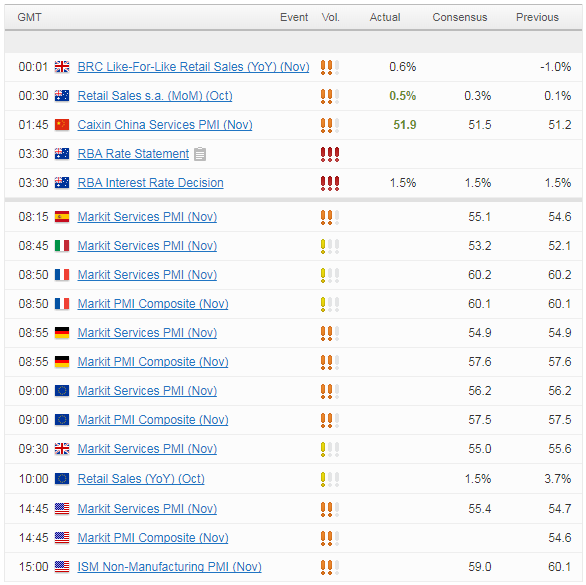

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.