Oil trading shows signs of life in Asia trading with, WTI dropping on a higher Baker Hughes while Brent holds steady.

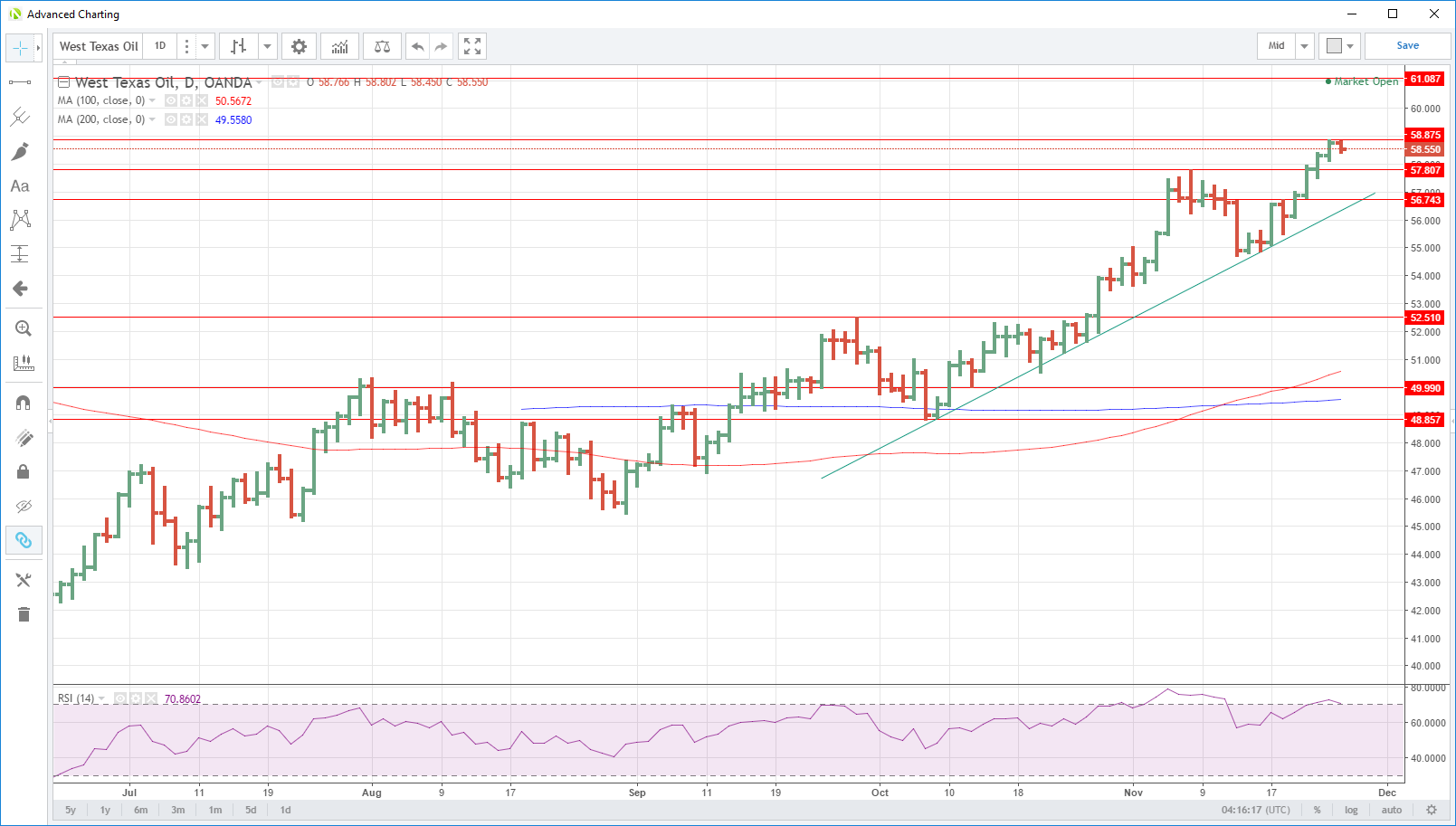

The price action in crude diverged in Asia this morning with WTI falling 0.40% to 58.55 while Brent crude enjoyed a small 0.12% gain to 63.88. The difference in price action was likely due to the Baker Hughes Rig Count data showing that eight rigs were added by shale producers in the U.S., as well as slightly overbought technical indicators.

Brent’s downside, in particular, should be limited ahead of Thursdays crucial official OPEC meeting where we are expecting the production cut agreement to be rolled over to cover all of March 2018. The street has pretty much priced this in as a done deal, so anything less would almost certainly see both contracts coming under renewed selling pressure.

Brent crude continues to bubble under strong resistance at 64.40 and 64.75, both levels being daily double tops. It has interim support nearby at 63.50 with a break implying we could see a corrective sell-off to the next support at 62.30. Below this level is the crucial 61.25 multi-day low from early November.

WTI’s relative strength index (RSI) continues to be at very overbought levels implying that it will find the going hard to the topside as the week starts. Like Brent, it is vulnerable to profit taking and position squaring ahead of the OPEC meeting. Initial resistance is at 58.90 with initial support at 57.80. A break of this level opens up a possible correction to 56.75 ahead of the trendline support at 56.30 today.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.