Gold and Silver are looking shaky as the week starts, with Saudi Arabia’s new broom looking as if it will provide only temporary relief.

Gold

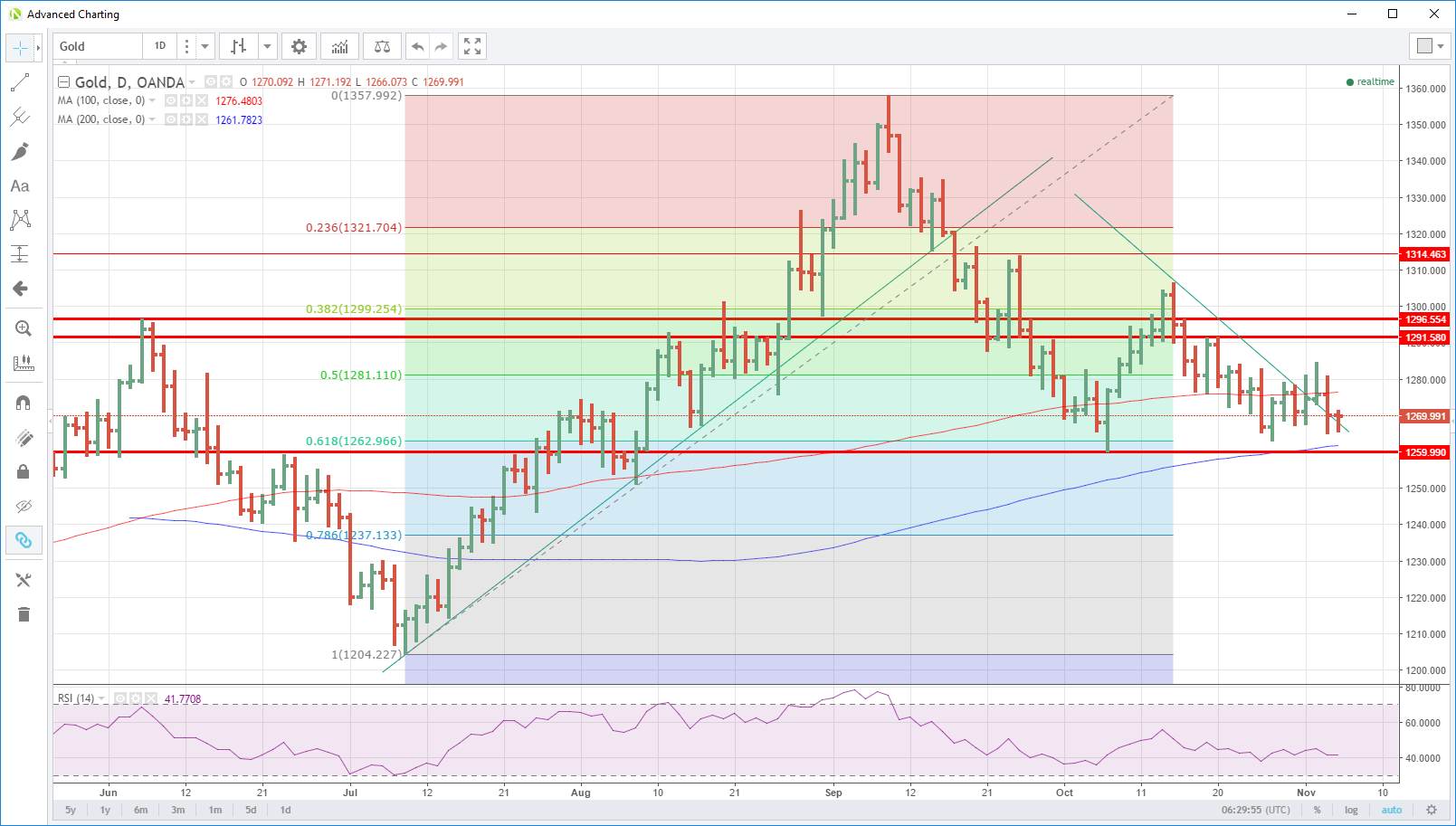

The U.S. dollar reigned supreme following Friday’s U.S. employment data which was bad news for gold, as it wilted and fell from its highs at 1280.60 to 1265.50 at one stage, before climbing off the canvas to close at 1270.00. The dollars march has nipped gold’s incipient rally in the bud and traders will be nervously looking at critical long-term support below as the week gets underway.

Gold spiked lower again on its open to 1266.00, just above Friday’s low before recovering to an unchanged 1270.00 by mid-morning. Gold seems to have found some safe-haven support after the initial sell-off as the street nervously watches developments in Saudi Arabia over the weekend following the mass arrests of prominent citizens on suspected corruption charges.

Gold has resistance at today’s high of 1271.00 followed by the 100-day moving average at 1276.50 and then Friday’s high at 1280.60. The downside will attract more of traders attention though, with initial support between 1265.50 and 1266.00. It is followed closely by the 200-day moving average at 1261.80 and then the crucial long-term support line at 1260.00. Given the extended long futures positioning still in the market, this may we be the line in the sand for many of those positions with the exit door beckoning should it break.

Silver

Although still out-performing gold relatively, Friday’s dollar rally saw silver fail at the 200-day moving average for the third day in a row. It is now perched precariously above multimonth support and like gold seems to be gaining only a temporary reprieve from the weekend Saudi Arabia news.

Looking at the technicals, silver has failed yet again at the 200-day moving average (DMA), today at 17.1900. Lurking just above this level is a daily double top at 17.2945 ahead of the October 16th high of 17.4700.

Silver closed just below the 100-DMA at 16.8720 on Friday in a bearish turn of events. Its four-cent gain in Asia sees it just above here at 16.88425, but the rally has a definite dead cat bounce look to it. Friday’s 17.7845 low is initial support before critical trendline support at 17.7200. A break of this clear support line, dating back to early July, could spark some stop-loss selling.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.