US Futures Flat as 10% of S&P 500 Prepares to Release Earnings

US futures are mixed ahead of the open on Wednesday, a day after only the Dow managed to make fresh record highs while the others made only marginal gains.

Both the S&P 500 and the Nasdaq failed to replicate the moves in the Dow on Tuesday, having also come off more heavily on Monday, but they continue to trade around record high levels. The key focus for the indices this week continues to be corporate earnings, with a tenth of the S&P 500 due to report on the third quarter today. Visa, Boeing and Coca-Cola are among those that are scheduled to report before the market open.

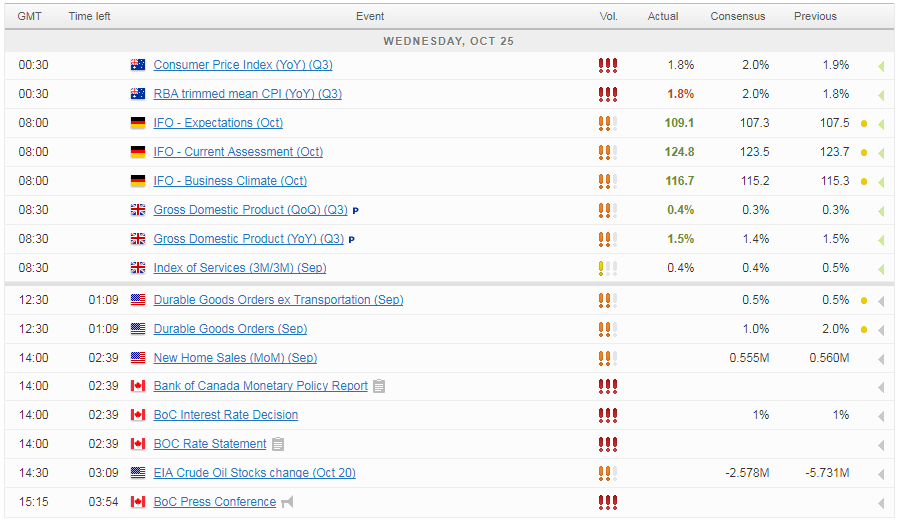

There will be some economic data to accompany the earnings reports on Wednesday, which has not and will not be the case for much of the week. US core durable goods orders – an important economic report offering insight into both current performance and expectations – will be released shortly before the open while new home sales will come a little later on.

CAC Moves Higher, ECB Stimulus Decision Looms

BoC Unlikely to Raise Rates for Third Consecutive Meeting

We’ll also get the latest monetary policy decision from the Bank of Canada today, although a third consecutive rate hike is not expected. The economy has cooled as of late, giving the central bank space to see how it copes with the rate hikes from July and September.

Traders will be more concerned with the central bank’s outlook for the economy and interest rates and whether it drops hints about further hikes. Given the data-dependent message it has stuck to previously, it may keep its cards very close to its chest and stick to the same line.

A number of risks still remain for the economy so the central bank will want to proceed cautiously. While household debts are a concern, the greatest risk right now is the NAFTA negotiations. Should they collapse, the economic impact could be significant and trigger a U-turn from the central bank. Of course, this is not the base case scenario at the moment – hence the previous two hikes – with it being in everyone’s interest to find a workable solution.

Sterling Pops Higher as UK GDP Raises Rate Hike Expectations

Preliminary data released on Wednesday showed the UK grew by 0.4% in the third quarter – 1.5% on an annual basis – ahead of market expectations and, more importantly, above what the Bank of England had anticipated. This is a very important point as the central bank had previously claimed that as long as the economy performs in line with expectations, it would likely raise interest rates at an upcoming meeting and today’s GDP data exceeded expectations, leaving the BoE with little reason not to proceed. It’s also the final major data release ahead of next week’s meeting leaving little opportunity for data to convince policy makers otherwise.

The only hope for those that believe it would be a mistake to raise interest rates given the uncertain economic outlook, is the fact that not all policy makers are behind such a move. With inflation having not risen above 3% last month, there is a possibility that policy makers wait a little longer before taking the decision. That said, the central bank could come in for some criticism if it doesn’t follow through on warnings now, with market having now priced in an 83% chance of a hike next week. The pound rallied on the back of this morning’s data, in line with the increased rate hike expectations, to trade around 1.32 against the dollar, which ultimately weighed on the FTSE 100, the only major index in Europe to trade in the red.

Source – Thomson Reuters Eikon

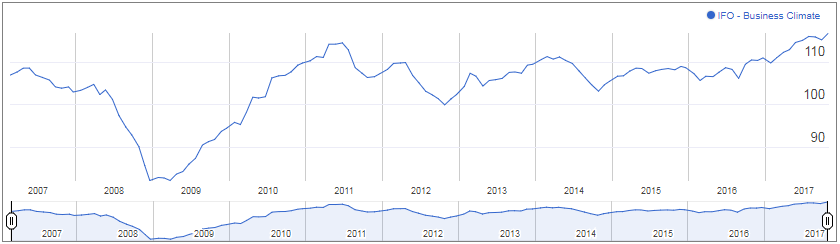

Euro Higher as German Business Optimism Hits Record High

The euro has also been given a small boost this morning after the German Ifo survey for October recorded its highest ever reading, with optimism about the months ahead contributing significantly to the spike. While Germany was once seen as the engine of growth for the entire euro area, it seems businesses have become increasingly confidence in the broader recovery this year which has created an environment in which the economy can prosper.

While the recovery in the eurozone has stood out this year, the global economic outlook is generally looking much better and the improved performance elsewhere – particularly China – is likely also feeding into the optimism. While there remains a number of underlying risks in the economy, there is a belief that momentum is growing and stronger growth could lie ahead, although should these risks begin to resurface, it may not take much to rattle investors and the business community.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.