Attention Turns to Fed Speakers After Minutes Offer No New Rate Clues

The US trading day is shaping up to be far more interesting than the Asian and European sessions that preceded it on Thursday, with central bankers making appearances in large numbers, while earnings and economic reports will also attract some attention.

The FOMC meeting minutes, released on Wednesday, had the potential to be the week’s most notable economic event but as many expected, there was very little in them that we were not aware of. We saw some softness in the dollar shortly after but this had been building prior to the release and I’m not convinced that many officials being concerned that inflation may not be transitory is the revelation it was made out to be.

The dollar may have weakened a little in the aftermath but yields on US Treasuries were broadly unfazed by the release. The dollar continues to look very oversold and a key test of this will likely come in the weeks ahead, with 92.50 being notable support in the dollar index and 94 resistance to the upside. A break above here could trigger a decent rally in the greenback, something that wouldn’t entirely surprise me into the end of the year.

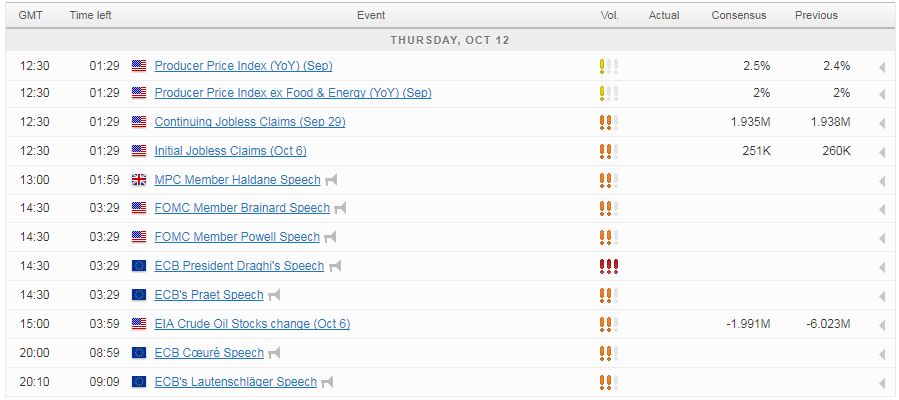

Source – Thomson Reuters Eikon

We’ll hear from two permanent voters on the FOMC today, Lael Brainard and Jerome Powell, the latter being one of the final candidates rumoured to be being considered to replace Chair Janet Yellen in February. Both have been among the moderately hawkish members of the central bank but appear to fall very much in the unconvinced category, when it comes to the debate on inflation. It will therefore be very interesting to see what they have to say today, should they address it of course.

Draghi Joins a Host of ECB Speakers Today Ahead of Key Meeting in Two Weeks

Other central bankers due to speak today include Mario Draghi and his colleagues at the ECB Peter Praet, Benoit Coeure and Sabine Lautenschlager, among many others. On the economic data side, we’ll get PPI inflation data from the US for September, alongside weekly jobless claims and oil inventory data from EIA. This follows a report from API on Wednesday which indicated a build of just over three million barrels last week, which if replicated would comfortably exceed expectations of a small decline. Earnings season also got underway this week and while we’re still in the quieter early stages, we will get reports on the third quarter from JP Morgan and Citigroup.

USD/CAD Canadian Dollar Higher After Predictable Fed Minutes

Rajoy Offers Ultimatum to Catalan Government

It’s been a relatively quiet morning in Europe so far, with focus there still very much being on the constitutional crisis in Spain as Catalonia prepares to declare independence following its questionable and illegal referendum and Madrid prepares countermeasures. Spanish Prime Minister Mariano Rajoy has given the Catalan government eight days to drop its independence bid or risk losing its political autonomy, a move that would likely spur further unrest. So far the negative impact of this has been limited to Spanish assets, although the IBEX has recovered quite well over the last week.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.