OPEC comments unleash pent-up demand in oil overnight with WTI the main beneficiary.

Crude oil prices shot higher overnight with WTI gaining a spectacular 2.80% and Brent a more modest but still respectable 1.55%. The gains left WTI comfortably above $50.00 a barrel closing at 50.80 in New York while Brent regained the 56.00 level to close at 56.70. With the first of the crude inventory repo0rts due tonight in the U.S. from the American Petroleum Institute(API) expected to show a resumption of the drawdowns in inventories, both contracts enter the later part of the week in a healthy state and seemingly poised for more gains.

The OPEC Secretary General got the ball rolling suggesting that world growth and Opec/Non-Opec compliance has the world oil markets rebalancing well underway. He also hinted that the grouping would take any means necessary to ensure this continues at the November 30th meeting. A host of trading houses echoed this view, and Saudi Arabia announced better than expected compliance cutting over 0.5 million barrels a day in September.

Chatter that shale producers are struggling to raise production and dealing with increased costs probably accounted for the WTI outperformance overnight. A return of U.S. traders from Monday’s national holiday also helped.

Brent spot is unchanged at 56.75 this morning with resistance just above at 57.00 initially. A break opens a test of the double top at 57.40 which in turn clears the way for a retest of the 58.50/59.00 resistance zone. Support is at 55.80 and then the 55.00 area.

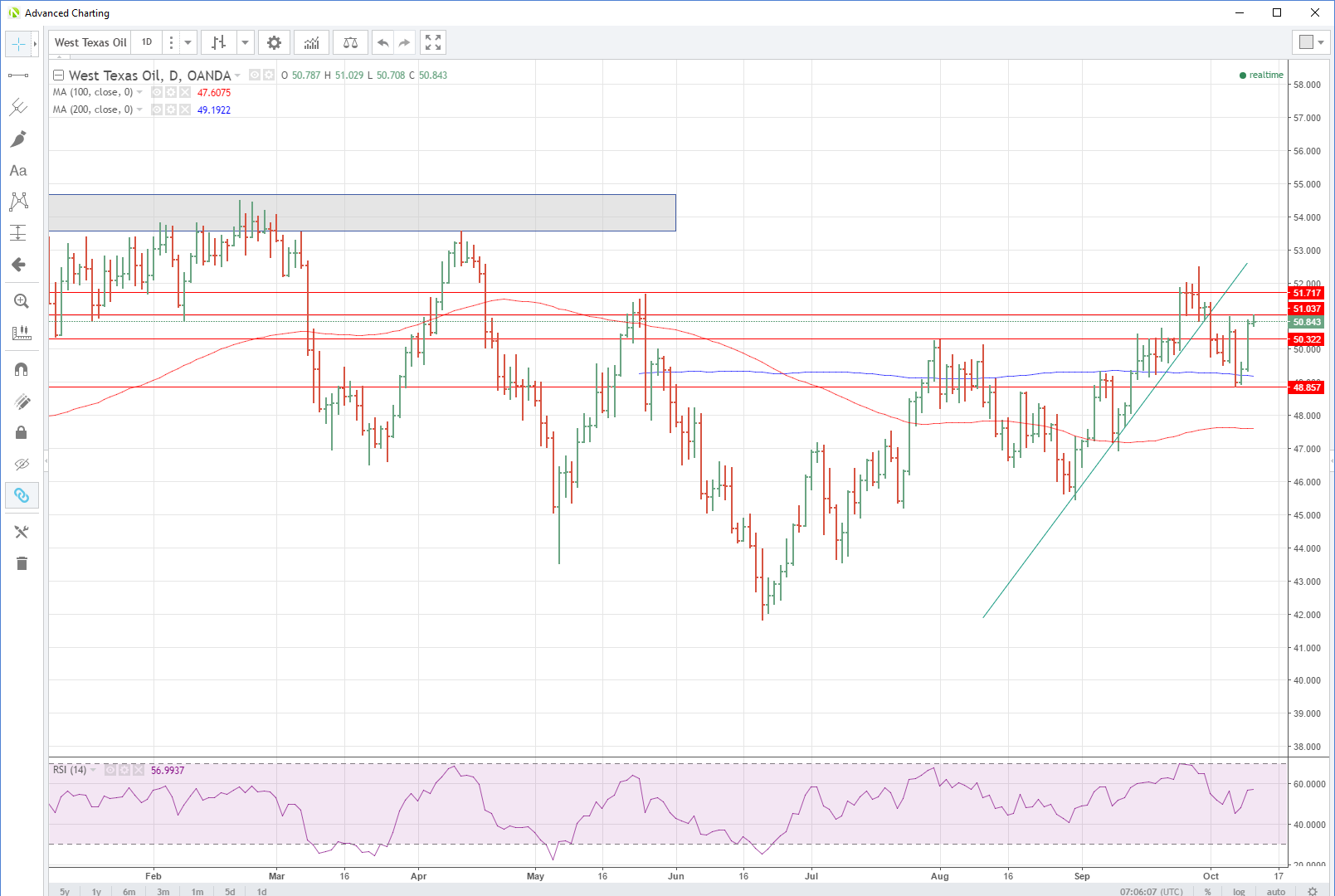

WTI’s march higher sees it trading at 50.85 in early Asia, its New York high. There is resistance at 51.00 followed by 51.40, which if broken, clears the way for an advance on last weeks high around 52.50. Support comes in at 49.20, the 200-day moving average, and then 48.80, the lows of Monday and Tuesday.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.