US Inflation, Income and Spending Numbers Key as Fed Uncertainty Grows

US equity markets are expected to open relatively unchanged from Thursday as we await the release of some important inflation data, as well as other key US economic metrics.

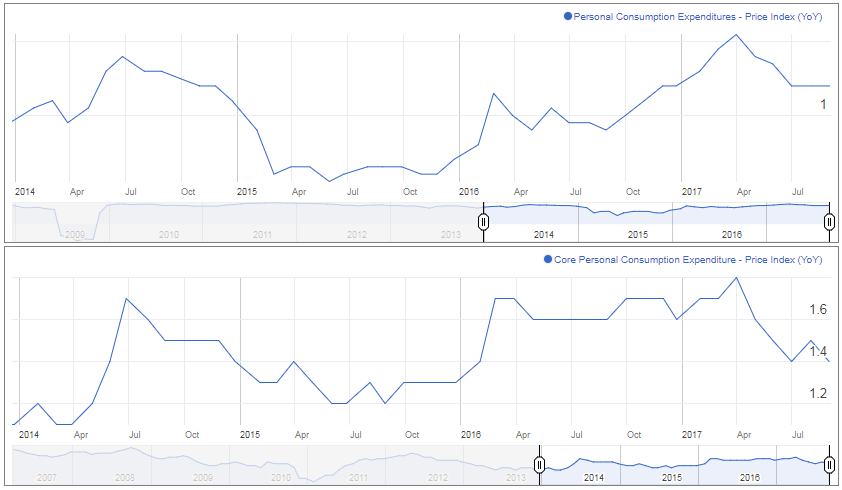

The inflation data clearly stands out today as, despite it coming a couple of weeks after the CPI numbers for the same month, it is the Federal Reserve’s preferred measure of inflation as comes as policy makers appear uncertain about the correct approach to interest rates. The central bank recently claimed that it still intends to raise rates one more time this year with support among policy makers for such a move actually increasing and yet, the tone coming from officials themselves suggests there’s a serious lack of conviction.

GBP/USD – Pound Dips as UK Current Account Deficit Ballons

Concerns about inflation not progressing towards target are clearly increasing among some of the more dovish policy makers at the Fed and another weak reading today won’t help matters. Should we see some improvement, as is expected with the PCE price index seen rising to 1.5% from 1.4%, it may be just enough to get one more rate hike over the line in December, assuming of course that it doesn’t reverse course again over the next couple of months.

Personal income and spending figures will also be released alongside the inflation data, both of which are also important metrics as it offers some insight into possible future inflationary trends and economic performance. It’s no secret that the US economy is driven by the consumer so higher incomes and spending should make the Fed’s job that much easier. The UoM consumer sentiment survey should also provide some insight into this.

Sterling Slides as Q2 GDP is Revised Lower

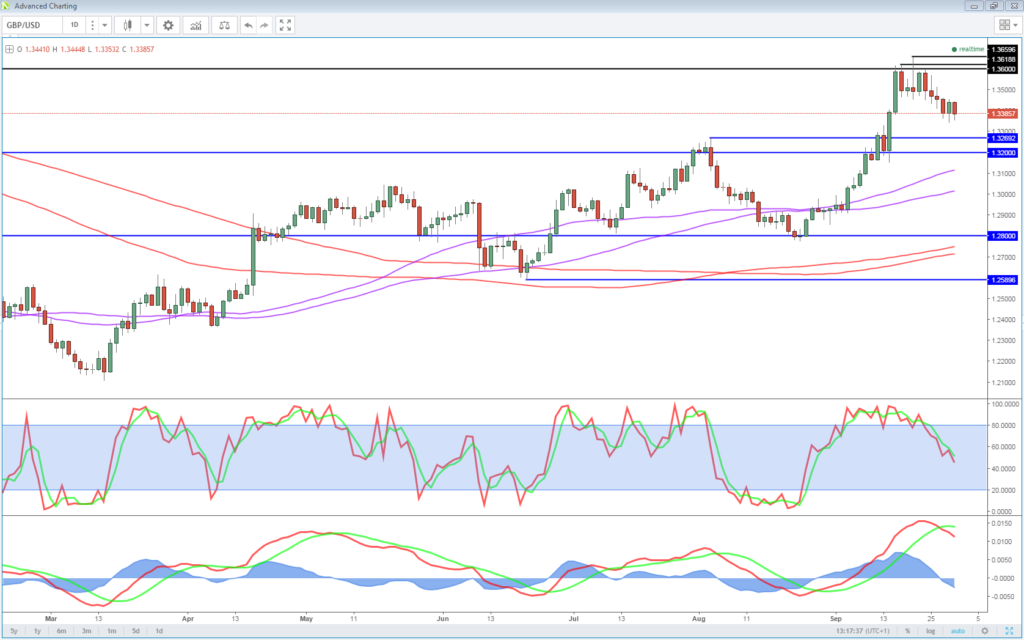

The pound has come under some pressure on Friday having previously been on a great run on the anticipation that the Bank of England will raise interest rates this year. Softer GDP data for the second quarter of 1.5%, down from previous estimates of 1.7%, triggered the slide in the pound, which was already looking a little vulnerable following recent moves. While the downside looks limited as long as the BoE follows through on rate hike plans, a sustained move above 1.36 against the dollar also looks a little far-fetched on the possibility of one hike and very gradual hikes thereafter.

OANDA fxTrade Advanced Charting Platform

IBEX Lower as Caution Grows Ahead of Catalonia Referendum

Interestingly, the IBEX is the only major European index trading in the red this morning as we head into a weekend in which Catalonia is planning an illegal independence referendum. While the outcome of the referendum, should it go ahead, is unlikely to change anything in the near-term, if at all, there is clearly a little caution about what the outcome will do to investor sentiment in the region and whether it could trigger a series of events that ultimately leads to it gaining independence. As it is, I don’t see much threat from this weekend’s referendum and there’s a good chance that efforts to stop it from Madrid will be successful.

Trumps Reflation Trade on Hold

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.