Brent and WTI explode higher as global tensions uncap Brent’s long-term resistance.

The wellhead was uncapped, and oil gushed higher overnight with Brent rising nearly four percent and WTI three percent. Sabre rattling rhetoric from Iran and North Korea sent jitters through the market, but it is the Kurdish independence referendum that had the most effect. Both Iraq and Turkey are threatening to cut off the Kurd’s export routes in the event of an almost certain yes vote.

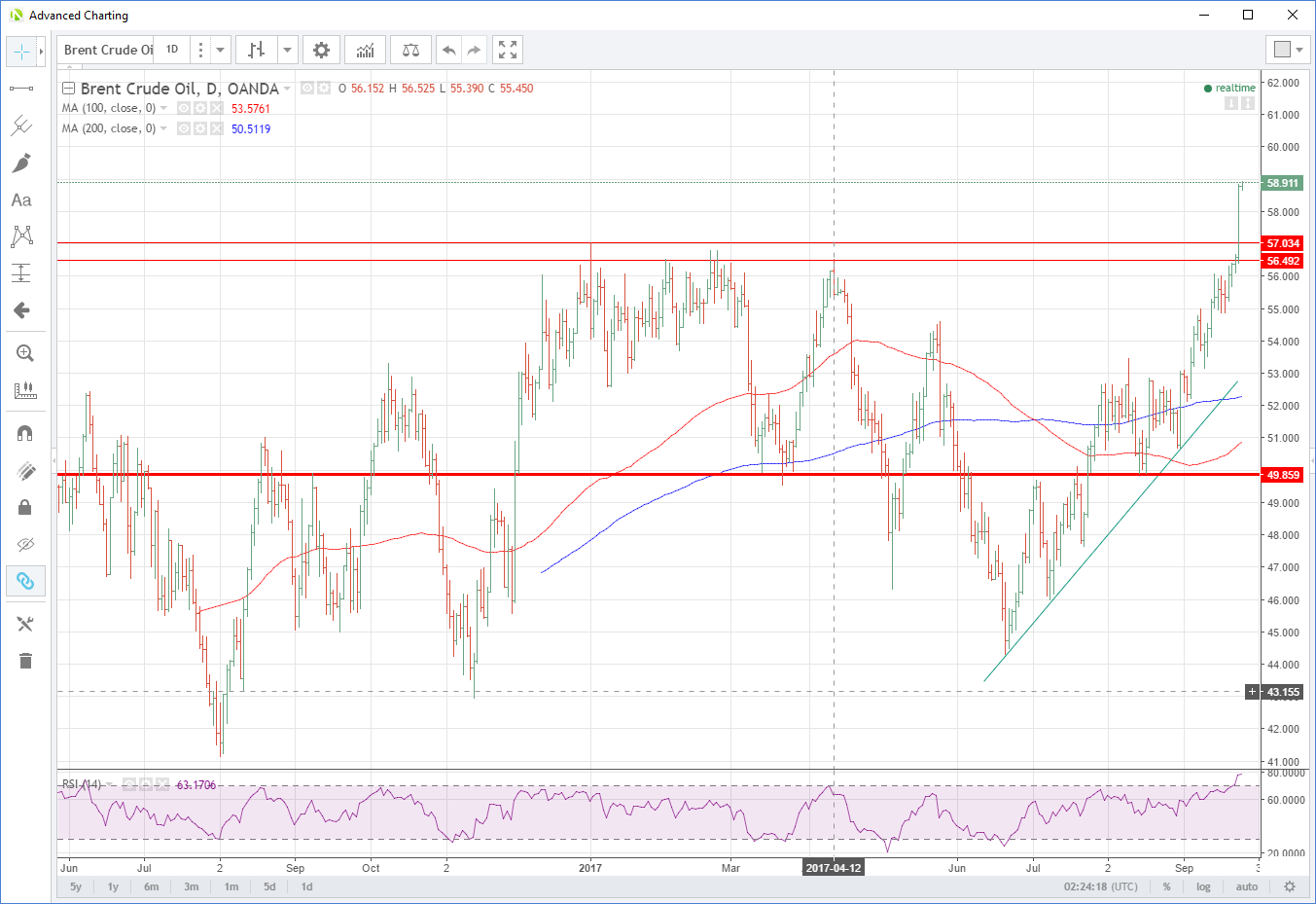

Healthy global demand according to the IEA has played its part, and the prompt futures backwardation in Brent has finally seen it break long-term resistance. The outperformance of Brent can be partially explained by stop-loss and model buyers coming to the market once the 57.00 level broke. However, some caution is warranted at these levels with the relative strength indices (RSI’s) of both contracts very overbought. In Brent’s case extremely overbought. It leaves both vulnerable to a downside correction or at the very least multi-day sideways consolidation.

Brent

Brent spot trades flat in Asia at its previous session highs at 58.75. Having broken the long-term 56.50/57.00 regions, this now becomes a pivotal support in the short term. Above here, the psychological 60.00 a barrel level will be formidable initial resistance at such overbought levels.

WTI

WTI spot trades slightly of its New York highs at 51.70 in early Asia. Initial resistance is nearby at 51.85 followed by April’s high at 53.60. Given the level of the RSI, this will be a tough nut to crack in the short term. Initial support is at 51.30 followed by the more distant 50.30 regions and then 50.00.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.