Another weekend of potential headline-driven volatility is negotiated safely, putting precious metals under pressure to start the week.

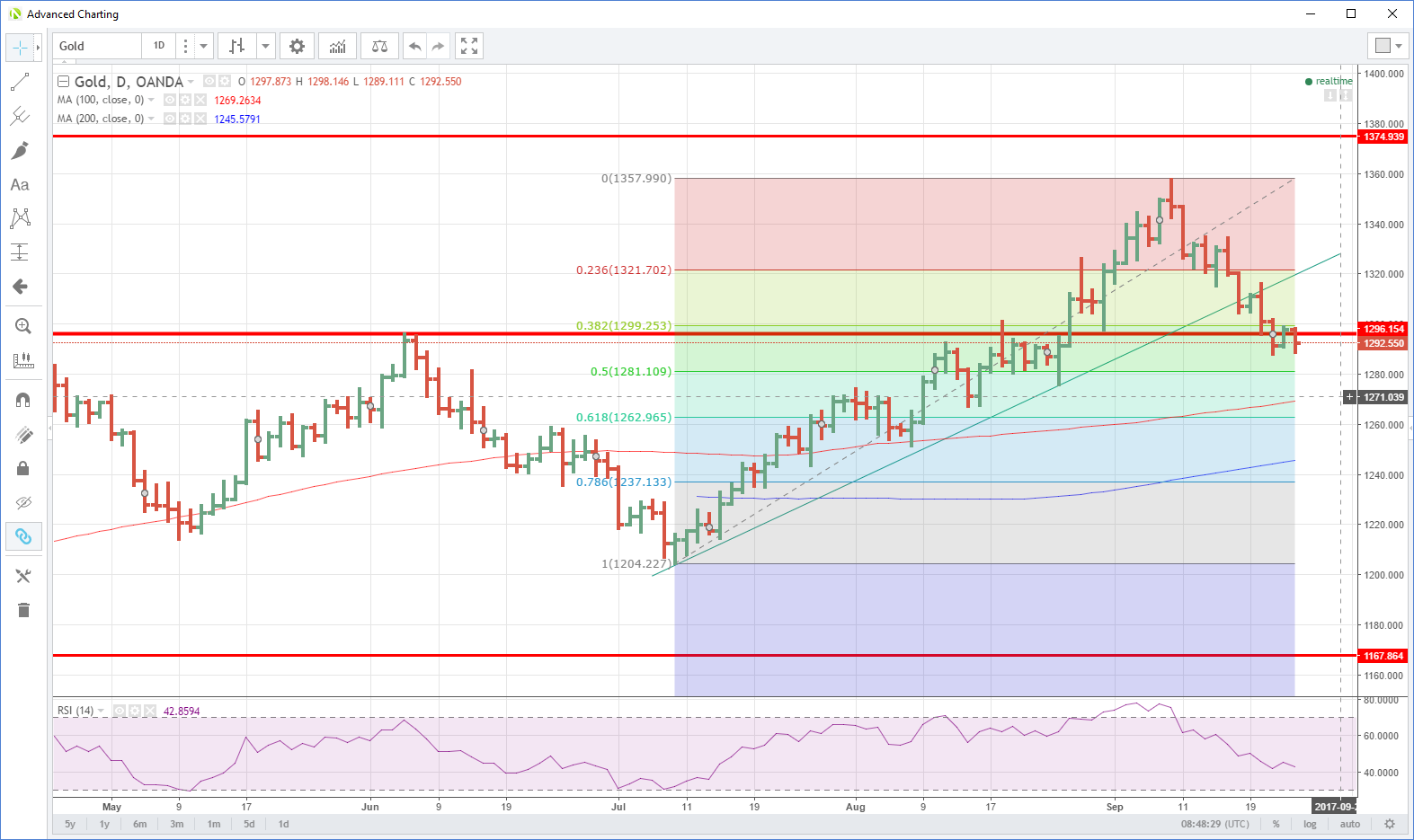

GOLD

Gold opened lower in early Asian trading, falling seven dollars from its New York close at 1297.00 to 1290.00 as weekend uncertainty passed without incident. Merkel’s win in the German federal elections and a quiet news weekend on the North Korean front, saw the U.S. dollar opening stronger and gold’s weekend safe-haven premium eroded from Friday.

Gold has bounced slightly to trade at 1292.85 but is now well below its 1296.00 breakout level with a daily close below here implying a deeper correction is possible. Gold is now mid-range between its 38.2% Fibonacci at 1299.00 and its 50% Fibonacci at 1281.00, and for longer-term bulls, this region is where gold’s correction should base. A break of the later level would suggest that the bull run has come to an end for now.

Intra-day gold has support at 1288.00 with resistance at 1296.00 and 1301.00. The Asian session’s performance will now be dictated by whether most of the weekend risk hedges have already been unwound and geopolitical headlines.

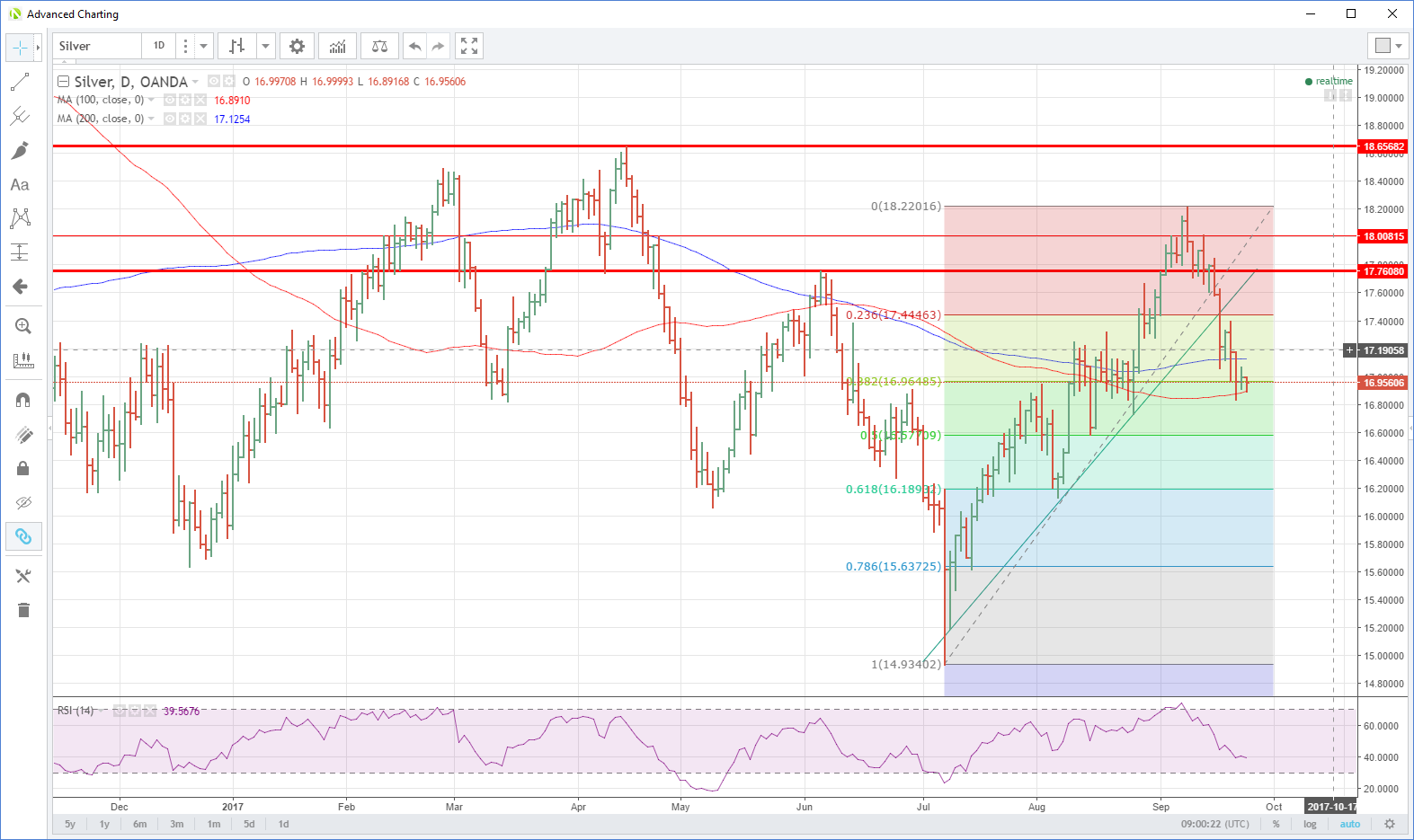

SILVER

Silver too is approaching the region between it’s 38.2 and 50.0 % Fibonacci retracements, where, if the bull market is to continue it should make a longer-term base. The technical picture though is somewhat more cloudy.

Silver broke its long-term support at 17.4550 last week and kept on falling. Furthermore, it has broken through its 200-day moving average at 17.1250 and seems poised to attack its 100-day moving average and initial support at 16.8900. A break of this level could imply a further drop to the 50.0% retracement at 16.5700.

The 200-day average at 17.1250 will offer resistance to any bounces before 17.4000 appears on the horizon.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.