Inflation Target Continues to Elude Central Banks

US futures are pointing to a relatively flat open on Thursday as we await the latest monetary policy decision from the Bank of England and inflation data from the US.

Both central banks are facing similar and yet very different conundrums, with the UK experiencing above target inflation but slowing growth and economic uncertainty and the US stronger growth and a booming labour market but only moderate below target inflation. While pressure is growing within the BoE to raise interest rates in order to bring inflation back down to target, the opposite is true at the Fed where the desire to raise rates is deteriorating as inflation remains stubbornly low.

CAC Unchanged as French CPI Matches Estimate

Are Hawks Gaining Ground at BoE?

The Monetary Policy Committee at the BoE is expected to remain divided today, with two policy makers – Michael Saunders and Ian McCafferty – expected to stick to their guns and vote for a hike but there is the potential that others may join them. The most likely is Andy Haldane – Chief Economist at the BoE – who has indicated previously that he’s not a million miles away from crossing the divide. With two new policy makers having also recently joined – one two months ago and one this month – there is also an element of the unknown in respect to how they will vote.

Rate hike expectations have been ramped up in the markets, with 10-year Gilt yields having risen from 0.957% less than a week ago to as high as 1.164% earlier today, which has coinciding with a strong rally in sterling. The inflation data earlier in the week contributed to this but the rally actually started before so clearly expectations aren’t just based on that one release. Sterling could build on gains if we see any indication that a consensus for a rate hike is building.

Watch Sterling, it Could Fly on BoE Decision

US Inflation Data Key Ahead of Next Weeks Fed Meeting

With inflationary pressures continuing to elude the US and complicate the Fed’s tightening plans, today’s CPI data for August will naturally be monitored very closely. While the CPI number isn’t the Fed’s preferred measure of inflation, it is released two weeks before the core PCE price index and before next week’s meeting, at which the central bank is expected to announce plans to begin reducing its near $4.5 trillion balance sheet.

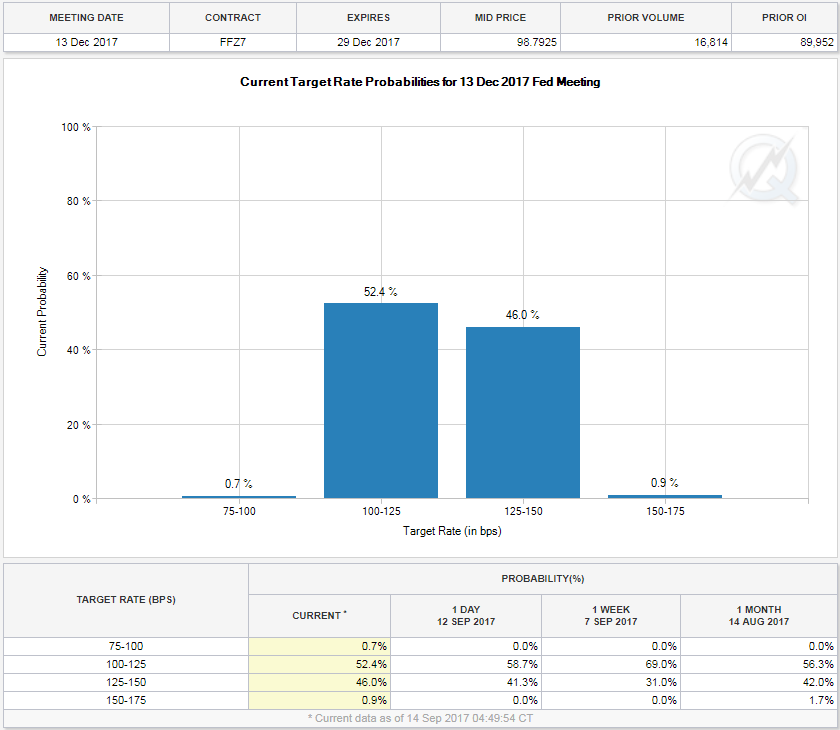

Traders haven’t been overly concerned about the tightening aspect of this until now but they are concerned about whether the Fed will delay plans for another rate hike before the end of the year. Markets are currently pricing in only a 47% chance of a December hike at the moment, with growing concerns within the Fed about the below target inflation clearly taking its toll. Further disappointing data today won’t make policy makers any more incline to pursue further hikes in the coming months.

Source – CME Group FedWatch Tool

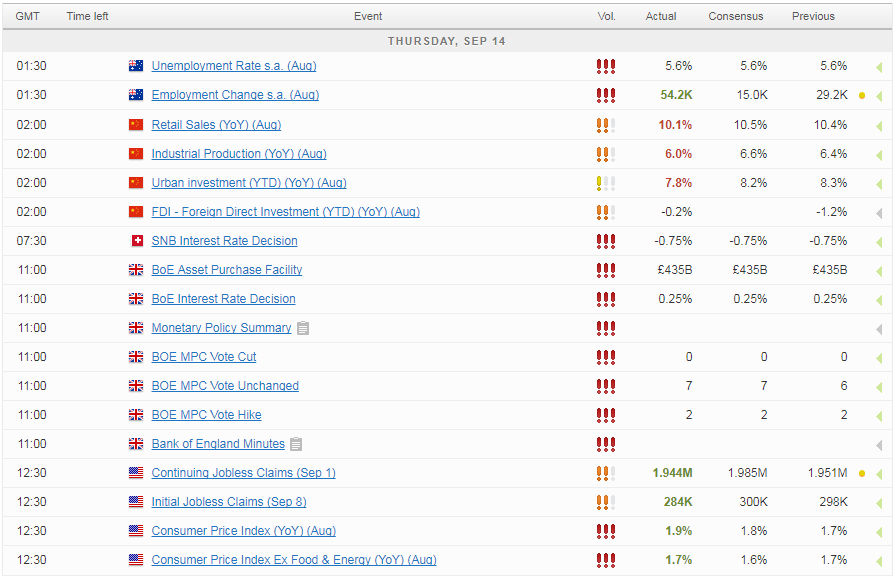

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.