North Korea Concerns Weigh on Risk Appetite

US futures are almost flat ahead of the open on Wednesday, broadly reflecting the kind of moves seen elsewhere as safe haven flows subside but risk appetite remains weak.

There is clear concern about the escalating tensions between the US and North Korea which has culminated in repeated stints of risk off trading in recent weeks. With the increasingly frequent tests in North Korea triggering such moves, it’s making traders a little more anxious than normal and it seems that for now, sitting on the side-lines is preferred.

The verbal back and forth isn’t helping matters, although it is having less of a negative impact than it was a few weeks ago. Should the tests in the North and military exercises in the South continue in the coming weeks, it is possible that traders start to pay less and less attention on the belief that this is as far as it will go. For now though, no such confidence clearly exists.

USD Struggling at Lows as More Fed Officials Voice Inflation Concerns

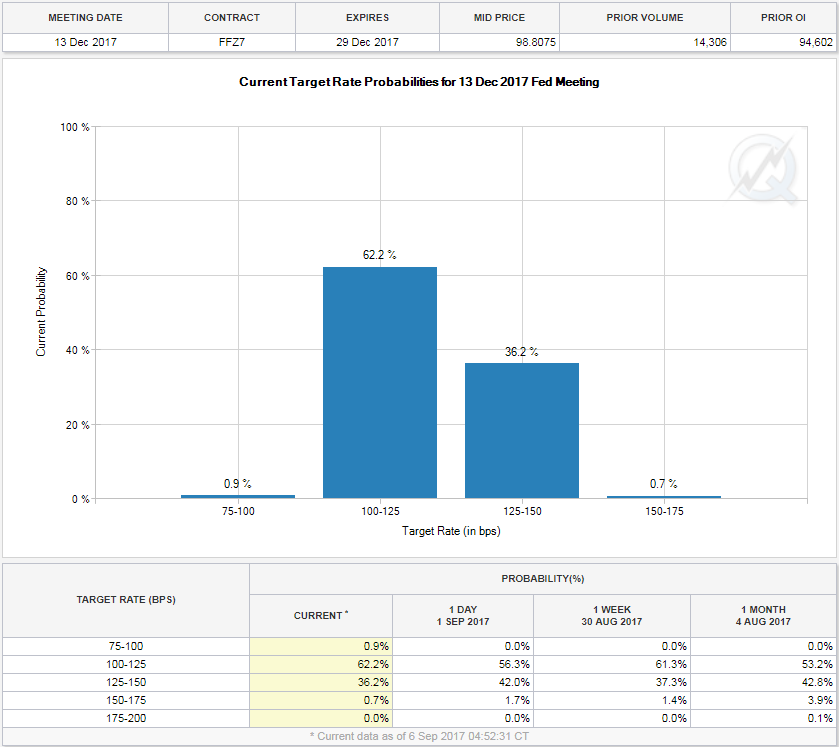

The US dollar’s traditional position as a safe haven currency is doing little to support it at the moment. Dovish remarks from three Federal Reserve officials on Tuesday appeared to further drive home the belief that another rate hike this year now looks increasingly less likely. It seems that few voters on the FOMC are still confident that inflation is on the right trajectory and instead a wait and see consensus has been building. With the market implied odds of a rate hike now standing at 37% and Fed commentary now reflective of this, a significant improvement in the inflation outlook may be needed to secure the third hike the central bank previously anticipated.

Source – CME Group FedWatch Tool

BoC May Signal Another Rate Hike This Year

The only interest rate decision that matters today though is that from the Bank of Canada, which began tightening at its last meeting in July – its first hike since September 2010 – and is expected to do so one more time this year. This meeting may come a little soon though, with investors expecting the central bank to remain on hold for now but they will be keen to hear whether expectations of another are correct. With inflation so far below target, there is good reason for the central bank to leave it at one for now but with the last having also come at a time when inflation was low, it may not act as a deterrent should they wish to go again.

Will the Bank of Canada Surprise with a Rate Hike?

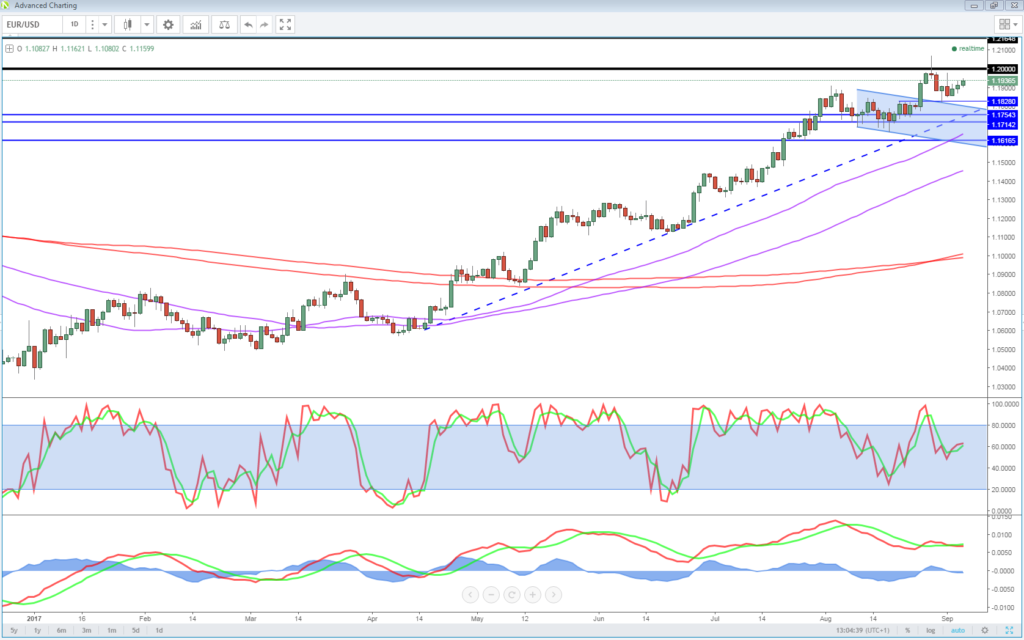

EURUSD Approaches 1.20 to the Dismay of the ECB

The euro is creeping higher against the dollar again today, moving ever closer to the 1.20 level that is proving tough to overcome. Not only are traders apparently wary of this level but the ECB has shown itself to be as well. I guess we’ll find out just how uncomfortable the ECB is tomorrow when it makes its monetary policy announcement and Mario Draghi holds his press conference. September had long been touted as the meeting at which further reductions to asset purchases would be announced but recent remarks would suggest they’ll hold off until later in the year before doing so, with the euro rate clearly a concern to them.

OANDA fxTrade Advanced Charting Platform

EUR/USD – Euro Edges Up Despite Weak German Factory Orders

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.