Gasoline futures crash as U.S. refinings rapid comeback alleviates the refined crude backlog.

Overnight crude trading was relatively quiet with most of the action occurring in gasoline futures, which slumped nearly four percent as U.S. refining capacity comes back online post-Hurricane Harvey. With almost all the affected refineries now operating, fears of gasoline shortages have evaporated along with its price rally.

WTI spot traded modestly higher by around 15 cents to start Asia unchanged at 47.35 this morning. Brent spot, by contrast, fell by 50 cents over the previous session, trading at 52.25 in early Asia. Traders continued to unwind the multi-year highs in the Brent/WTI spread by selling Brent and buying WTI.

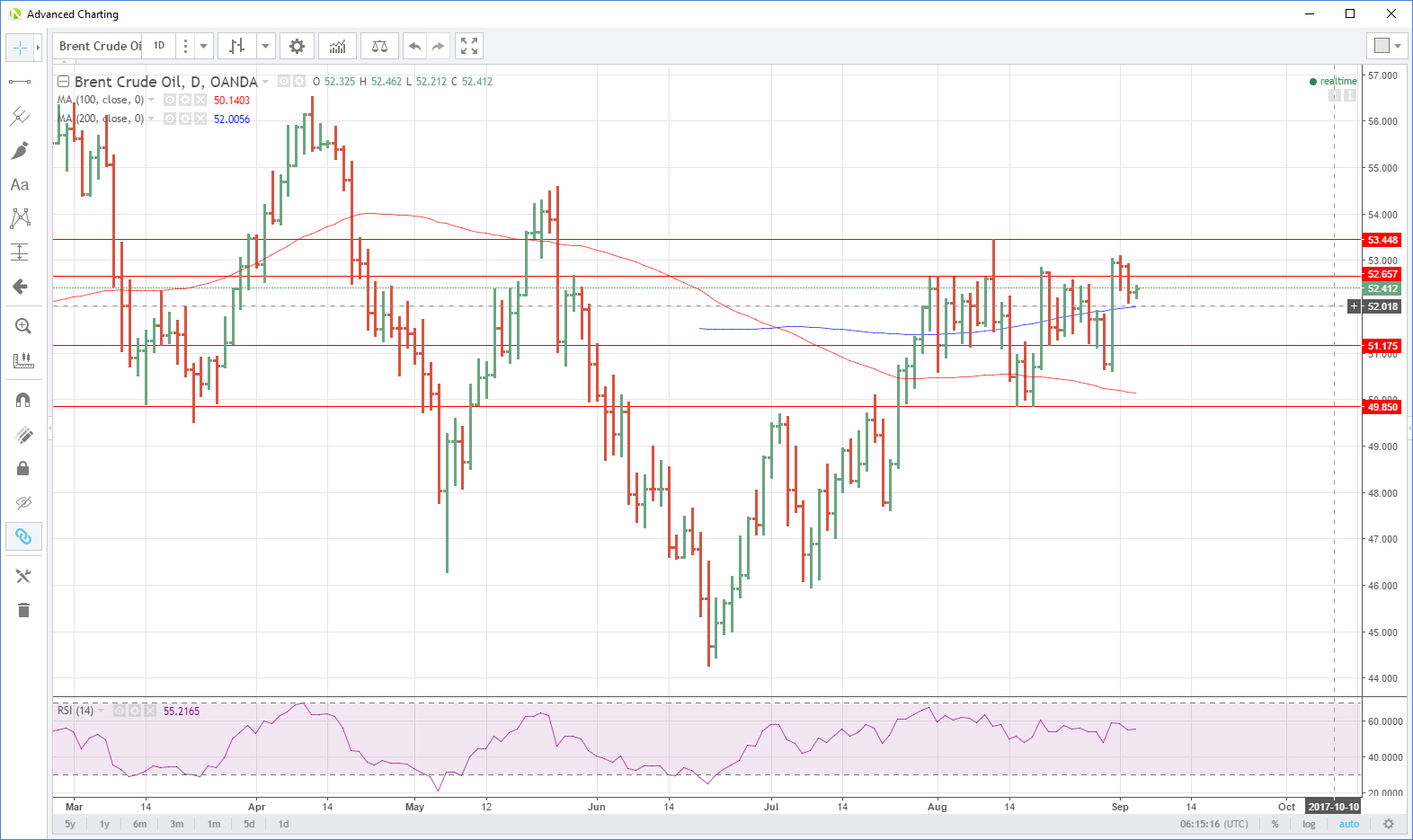

From a technical perspective, Brent spot continues to consolidate at the top of its recent range. It has resistance at 53.10 and 53.45 initially with support at 52.10 and trend line support at 51.60.

WTI spot closed just above its 100-day moving average and initial support at 47.25. It is followed by 47.00 and then 46.45. Resistance is at 47.60 and 48.00 with the contract likely to be supported by continuing spread unwinding ahead of the U.S. API Crude Inventories’ data tomorrow evening.

The crude inventory numbers this week come out one day later than usual. Both the API and official EIA inventory numbers could well show unexpected buildups against the recent trend of consistent inventory drawdowns. This will probably be a Hurricane Harvey effect, with crude oil stocks going into storage due to the extended refinery shutdowns of last week.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.