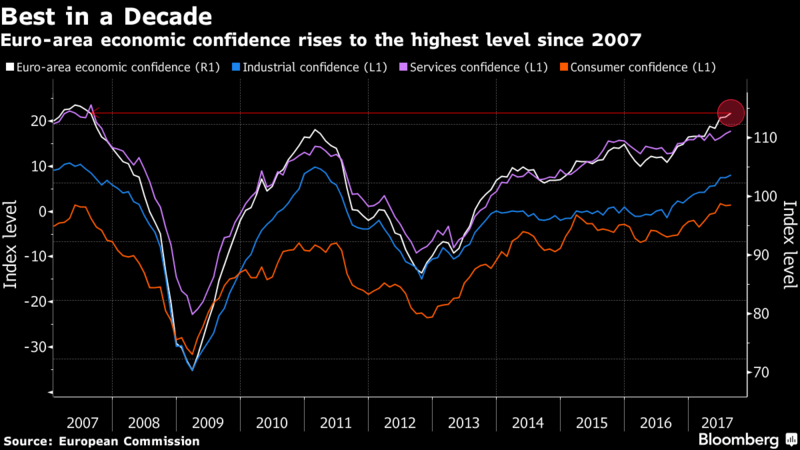

Euro-area economic confidence rose to the highest level in a decade as European Central Bank policy makers prepare for a discussion next week about whether and how to pare back stimulus.An index of industry and consumer sentiment increased to 111.9 in August from a revised 111.3 in July, the European Commission in Brussels said on Wednesday. Economists surveyed by Bloomberg predicted an increase to 111.3 from a previously reported 111.2.

The Governing Council is set to start deliberations about the future path of quantitative easing when it meets on Sept. 7. With a booming economy showing few signs of being matched by a sustained pickup in inflation and a surging euro threatening to further damp price pressures, policy makers probably won’t rush an exit.

Source: Euro-Area Economic Confidence Jumps to Decade-High Before ECB – Bloomberg

USD Pares Losses Ahead of Data and Powell Remarks

EUR/USD – Euro Edges Lower Ahead of German Preliminary CPI

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.