We’re seeing significant risk aversion in the markets on Tuesday, with European indices heavily in the red, US futures indicating a similar open on Wall Street, Gold at near-10 month highs and the yen making steady gains.

North Korean Missile Puts Investors on Edge

A ramp up in tensions between North Korea and the US, South Korea and Japan overnight has raised geopolitical risk once again, with Kim Jong Un showing no signs of ceding to international pressures. The missile launch comes as no surprise given proximity to the annual military exercises between the US and South Korea, but the fact that the missile was shot over Northern Japan and prompted warning sirens encouraging people to take cover is a concern.

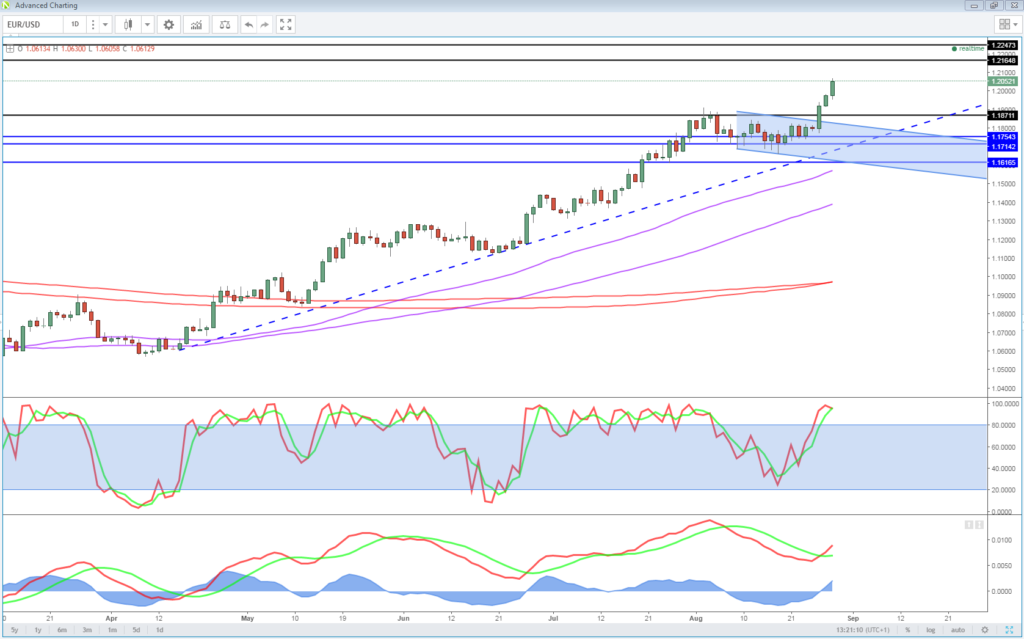

EUR/USD – Euro Jumps Above 1.20 as German Consumer Climate Picks Up

Hurricane Harvey Wreaks Havoc

The distressing impact of Hurricane Harvey in Houston is also weighing heavily on sentiment this morning. From a markets perspective, the uncertainty surrounding the cost and the economic implications of the storm is going to be a concern for investors, although it is difficult to look past the sheer devastation it has caused at the moment.

EURUSD Surges as Draghi’s Dovish Message Falls on Deaf Ears

The dollar is coming under significant pressure in the aftermath of the storm, which has taken the dollar index to its lowest since the start of 2015 and below the 92-93 support zone that has held firmly since then. This move has coincided with the euro trading at its highest against the greenback since the first trading day of 2015, which will be a blow to the ECB which has tried to repeatedly talk down the currency as it prepares to further reduce its quantitative easing program.

OANDA fxTrade Advanced Charting Platform

Draghi’s comments at Jackson Hole did little to halt the charge higher, with the ECB President keen to stress that “a significant degree of monetary accommodation” is still warranted, a statement which doesn’t suggest the current level will remain. He’s doing his best to talk down the currency but the fact of the matter is that he’d going against the tide, the ECB wants to taper and it looks as though it’s going to happen. Traders hear his words and are look past the dovish filler and instead focus on what he isn’t saying.

Safe Haven Gold Breaks $1,300

Gold is trading higher again on Tuesday, having finally broken through $1,300 on Monday driven by safe haven demand. The next test for the yellow metal should come around the November high around $1,337.40 but I think further gains could be in store.

Oil, Light Sweet Dreams Are Made Of This

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.