US futures are pointing to a higher open on Wall Street on Wednesday, as risk appetite continues its recovery ahead of the release of the FOMC minutes from the July meeting.

FOMC Minutes Could Offer Interest Rate and Balance Sheet Clues

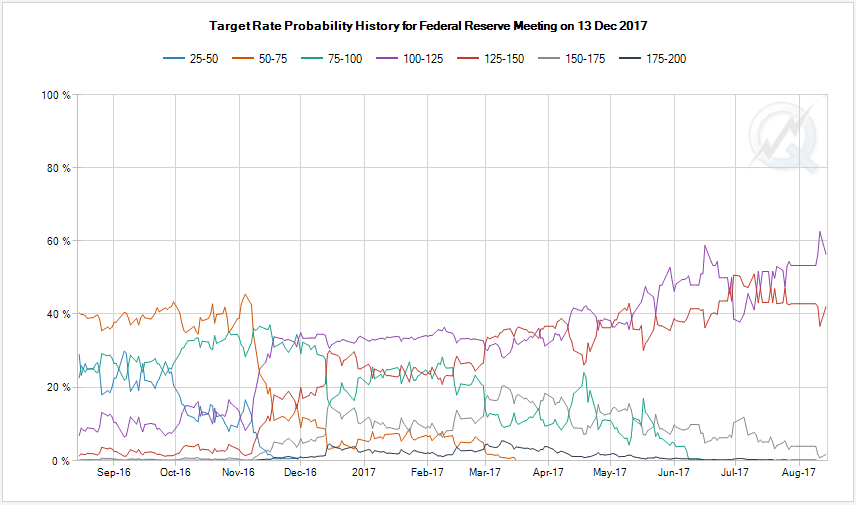

The Federal Reserve has become noticeably less hawkish in recent months as inflation has failed to pick up as much as policy makers had anticipated, causing some to question whether the current pace of tightening is appropriate. I expect the minutes will reflect this growing unease within the Fed which could once again weigh on interest rate expectations. Markets are currently pricing in only a 49% chance of another rate hike this year and even that has only been achieved in the last couple of days following some hawkish remarks from William Dudley.

Source – CME Group FedWatch Tool

Source – CME Group FedWatch Tool

The balance sheet is something else that traders will likely be looking for further clarity, with the central bank strongly hinting that it will start reducing it from September. The minutes may offer insight into how it plans to do so, although until now the market reaction to this has been very muted.

Dollar Torpedos Gold Whilst Oil Checks Its Inventory

EIA Expected to Report Seventh Consecutive Decline in Inventories

Other notable data points today including building permits and housing starts for the US, as well as crude inventory data from EIA. API reported a 9.2 million barrel draw down on Tuesday which didn’t provoke much of a reaction in the markets, despite the fact that a repeat of this today would represent the biggest drop since September last year and the seventh consecutive week of declines. Should EIA report a similar number then we may see a more significant reaction in Brent and WTI.

GBP Bounces on Stronger Labour Market Data

Sterling has rebounded slightly on Wednesday after the latest labour market data showed unemployment fell to 4.4% in the three months to June while average earnings rose by 2.1%. Both of these numbers exceeded market expectations offering some reprieve for the pound which suffered losses on Tuesday on the back of softer than expected inflation data.

OANDA fxTrade Advanced Charting Platform

While the numbers were generally good, the key takeaway from the release remains the fact that real wages are falling as wage growth lags behind inflation. While the gap between the two has narrowed and is likely to shorten again over the course of the next year or so, it is likely to continue to weigh on growth in the meantime. Even an apparently tight labour market isn’t easing the situation, with the Bank of England saying earlier this month that Brexit uncertainty is likely holding down wages.

Short Dollar Squeeze Continues

Eurozone Growth Momentum Accelerates in July

There was also good news for the eurozone this morning, with GDP data for the second quarter exceeding expectations at 2.2% and indicating that the recovery is becoming more broad based. The eurozone may be a little late to the party but we’ve seen significant improvement in the region over the last year and the latest figures are extremely encouraging. There is obviously still a long way to go but there is certainly reason for optimism.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.