Risk aversion is once again the name of the game on Thursday, as geopolitical tensions mount and investors head for cover in the traditional safe havens.

Gold and the Yen Extend Gains in Risk Averse Trading

The war of words taking place between the US and North Korea at the moment, which includes very real threats of action, is taking its toll on investor sentiment. The level of risk aversion we’re seeing suggests traders still believe the prospect of military action is very small but precautions are still being taken none-the-less, as this still has the potential to escalate very quickly and unexpectedly.

Standard safe haven instruments are still being preferred at this point, with the yen well bid against its peers and Gold a little higher after seeing strong gains on Wednesday, while equities are getting no love.

OANDA fxTrade Advanced Charting Platform

US futures are pointing to a negative open on Wall Street for a third consecutive session, coming on the back of new record highs being set after a very good earnings season. While companies are continuing to report in the background, it is clearly being overshadowed by geopolitics.

DAX Losses Continue as Geopolitical Tensions Continue

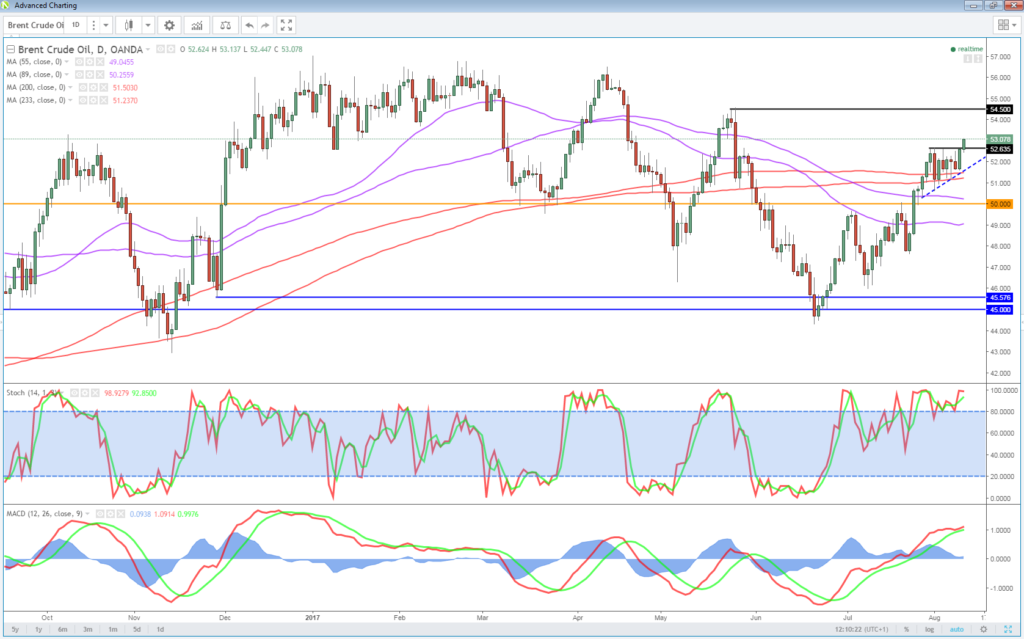

Oil Hits 10-Week Highs on Inventory Numbers and Saudi Reports

Oil is trading higher again on Thursday, buoyed by the inventory numbers reported this week and reports that Saudi Arabia is ready to cut supplies to Asia in an attempt to drain stores further. Geopolitics is also likely playing a small part as well, lifting Brent crude through its recent resistance to trade at fresh 10-week highs. While WTI is lagging behind a little, the moves of the last couple of days suggest $55 could be on the cards for Brent, at which point buying appetite will be tested once again.

William Dudley’s Comments Closely Monitored

Things will pick up a little on the economic data side today, although attention here is very much on tomorrow’s inflation numbers. PPI inflation data and jobless claims will both be released shortly before the US open, as will GDP data for the UK from NIESR. The GDP estimate covers the three months to the end of July so gives us an indication of how the UK started the third quarter. William Dudley – President of the New York Fed – will also be making an appearance on Thursday, which will be monitored very closely as he’s believed to hold similar views as – and be a close ally of – Fed Chair Janet Yellen.

North Korea Nerves Weigh on Equities again, Dollar and Gold Higher

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.