The July jobs report from the US appeared to tick all the boxes when the numbers were released, strong jobs gains, higher participation and unemployment back at 16 year lows. But as ever, there was one crucial component missing.

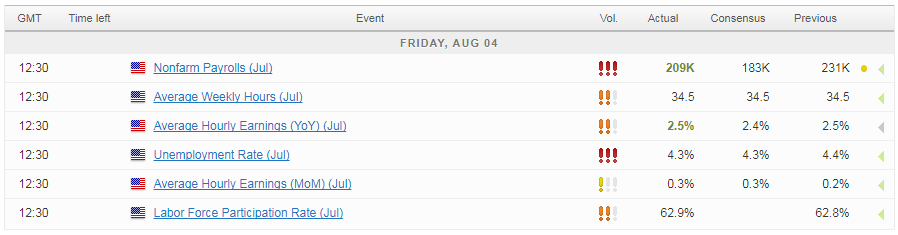

Earnings growth has eluded US workers ever since the global financial crisis and despite the labour market appearing to have tightened dramatically over the years, the path back to higher earnings continues to be a painfully slow one. The earnings numbers for June were once again the only disappointment in an otherwise stellar report, in which 209,000 jobs were added, unemployment fell to 4.3% and even participation ticked up to 62.9%.

July: Non-farm payroll (NFP) and CAD Employment Result

While the job gains and unemployment decline is what will probably make the headlines – and of course, Donald Trump’s Twitter feed – it’s the lack of significant earnings growth that continues to hold the economy back and frustrate the Federal Reserve. To make matters worse, earnings growth has actually slowed since the end of last year when, at 2.9%, it appeared progress was finally being made.

With all of this in mind, today’s report has probably done very little to alter the Fed’s position on interest rates this year. The dollar did rally immediately following the release – as it tends to when job gains exceed expectations – but with the dust settling and the reality of low wage growth hitting home, the bulk of the gains have reversed. It would appear that despite the barrage of data, traders are none-the-wiser on whether we’ll see another rate hike in 2017. Roll on September.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

EURUSD

GBPUSD

USDJPY

AUDUSD

USDCAD

NZDUSD

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.